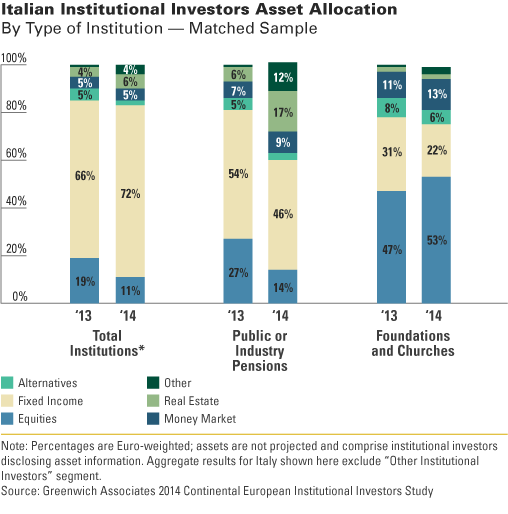

Results from the Continental European Institutional Investors Study revealed that investors overall have increased their allocations to fixed income and slightly decreased their exposure to equities. However public/industry pensions and foundations/churches have decreased their investments in bonds. Real estate now makes up 17% of portfolios versus 6% in year prior for Publics.

Other Findings to Help Support Your Business Strategy:

- Investors turn to diversification in the hunt for yield. Schemes, for example, see real estate and money market allocations as secure options to negate portfolio risk.

- All institutions cite the following factors as key drivers in allocation decisions (in order of most significant): asset return expectations, market volatility, liquidity, regulatory pressure, liability profile, and funding position.

- Meeting asset return expectations and market volatility are top-of-mind for Italian investors as most important issues facing the fund.

- When comparing expectations for future asset mix, public/industry pensions are following actions of greater Europe with institutions expecting to significantly increase exposure to infrastructure and real estate, along with European equities and global equities. On the contrary, domestic and government bonds assets are expected to significantly decrease.