Table of Contents

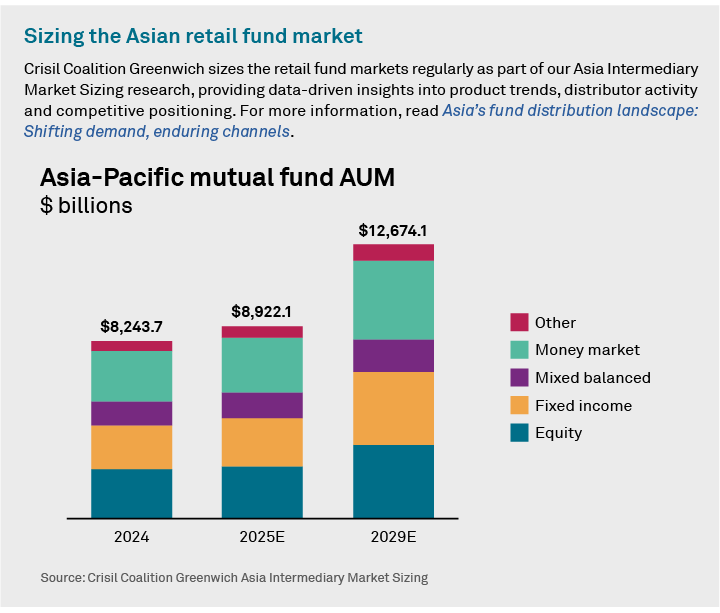

For the first time since 2022, Asian fund distribution platforms have reported positive net asset growth across equities, fixed income multi-asset funds.

Although year-to-year growth in each of these fund categories was relatively modest, the net expansion in the 2024–2025 period brought welcome relief to Asia’s retail and private banks, insurance companies, fund platforms, and other retail fund distributors, following three years of asset contraction in equities that preceded earlier declines in fixed income.

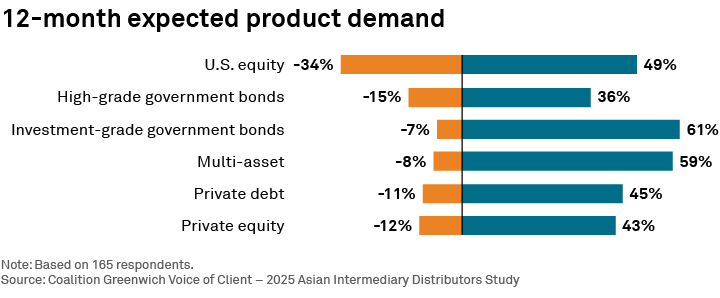

Fund distributors expect these favorable conditions to continue. Distribution platforms expect to see positive net inflows across the vast majority of fund types and strategies. Distributors are projecting the strongest demand for investment-grade bonds and multi-asset funds. They also expect to see a surge in demand for private assets. (See next section.)

On the flip side, enthusiasm for U.S. equities appears to be waning, at least somewhat. In 2024, about two-thirds of Asian fund distributors expected to see a significant increase in inflows to U.S. equities over the next 12 months. This year, that share dropped to 49%, and more than a third of distributors projected a significant decrease in flows. That change in attitude could reflect the timing of the Crisil Coalition Greenwich Study, where interviews were conducted in Q1 and Q2 2025. During that period, U.S. stocks underperformed international equities as U.S. markets experienced volatility and uncertainty surrounding the Trump administration’s tariff push.

In fixed income, distribution platforms expect retail investors to gravitate to quality. They anticipate demand to be highest for investment-grade and high-grade government bonds. Meanwhile, distributors are projecting a third consecutive year of significant net outflows from emerging markets debt.

Surging demand for private markets

Demand for private assets is growing on Asian fund distribution platforms. Approximately 45% of fund distributors expect to see a significant increase in inflows to private debt, and 43% are projecting big increases in private equity. In each case, only 10%–12% of fund distributors are predicting a decrease in flows.

Half of Asian private banks expect to see a major increase in demand for private debt from their investors over the next year. Momentum is also building on retail bank platforms, as asset managers roll out products that make private markets more accessible to investors. On net, Asian retail banks in 2024 predicted a drop in demand for private credit in the coming 12 months. This year, that outlook has reversed, with a net 26% of retail banks projecting a significant increase in inflows to private credit in the next year. The trajectory is similar in private equity, where expectations jumped from a net positive 16% in 2024 to net positive 30% in 2025.

How can asset managers capitalize on these favorable conditions?

Last year’s asset growth across fund categories and projections for continued strong demand in the years to come are undoubtedly good news for the bottom lines of Asian fund distributors—and for the asset managers who sell their funds on these platforms. However, the question now facing asset managers is how to capitalize on these favorable trends.

For asset managers, selling funds through Asian distribution platforms is a highly competitive business. While many retail banks, private banks and securities platforms will host hundreds of funds on their platforms, the median distributor includes only 15 funds on the “buy lists” that drive a huge portion of investor flows.

Every year, Crisil Coalition Greenwich asks gatekeepers for Asia’s largest fund distribution platforms to explain how they research and select asset managers and funds for inclusion on their platforms. We use the resulting data to advise asset managers on how best to market themselves and their funds to distributors. Every year we tell our asset management clients the same thing: Get on the plane.

Nearly two-thirds of gatekeepers for Asian distribution platforms say the main way they become aware of asset managers and products is by attending in-person industry events. Unfortunately for asset management travel budgets, just hitting a few of the region’s biggest industry gatherings probably won’t be enough. Gatekeepers rank in-house events as far more important than third-party events.

Of course, webinars can serve as a cost-effective marketing tool for asset managers looking to communicate with fund distributors and win placement on platforms located across the vast Asian region. However, from 2024 to 2025 the share of gatekeepers citing webinars as a key source of information on asset managers and fund products hovered at flat to slightly lower, while the share citing in-person events increased to 62% from 54%. Those results demonstrate clearly that the battle for placement and assets on Asian retail distribution platforms must be fought in real life.

That said, digital content, including both web sites and social media, will also play a key role. Gatekeepers for Asian distribution platforms pay significant attention to asset manager brands, with brand often being the most important factor when selecting new managers for their platforms. Social media and other digital content now represent essential tools in brand-building across industries.

Whether in industry events, in-person meetings or digital communications, asset managers competing for placement on distribution platforms should focus messaging first and foremost on the quality of service they deliver, both to distribution platforms and end investors, followed by other important factors such as risk management capabilities, industry, market and investment insights, and the stability of their investment teams.

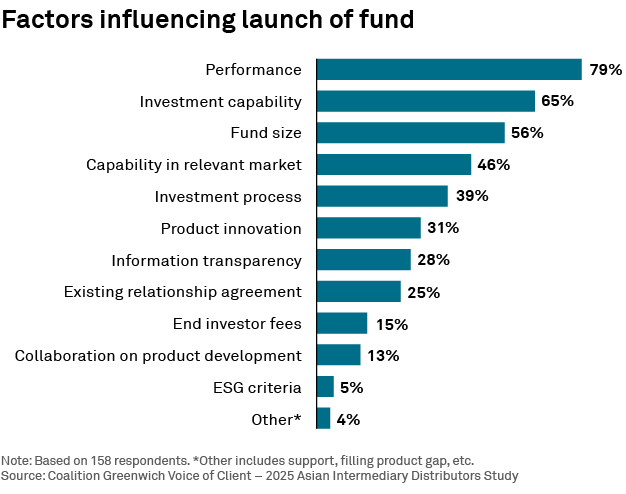

The graphic above shows what factors have the most influence on distributors’ decisions to launch a specific fund on their platforms. As the chart illustrates, performance plays the biggest role. The best way for asset managers to improve the odds that a specific fund is selected and launched is to focus on demonstrating the efficacy of the investment process that has delivered that performance.

Ken Yap, Head of Investment Management – Asia is the author of this report.

MethodologyBetween February and June 2025, Crisil Coalition Greenwich conducted 170 interviews with some of the largest fund distributors in Asia. Senior gatekeepers were asked to provide detailed information on their business priorities, quantitative and qualitative evaluations of their investment managers, and qualitative assessments of those managers soliciting their business. Countries and regions where interviews were conducted in Asia include Hong Kong/Macau, Malaysia, Singapore, South Korea, Taiwan, and Thailand.