More than 88% of U.S. active large-cap funds underperformed the S&P 500 over the last five years. In Europe and Japan, 74% of active large-cap funds underperformed similar index benchmarks over the same period1. Given this framework, investors have been shifting money into passive, index-tracking strategies and pushing back on the fees they are being charged.

In this Greenwich Associates research report, we examine these dynamics more closely and discuss how active asset managers can adjust to the ongoing shift toward passive. We will explore the techniques and data sets portfolio managers are utilizing to improve performance, the key traits of successful portfolio managers and potential opportunities for asset managers to diversify their product suite to attract new assets.

1 http://us.spindices.com/SPIVA/#/

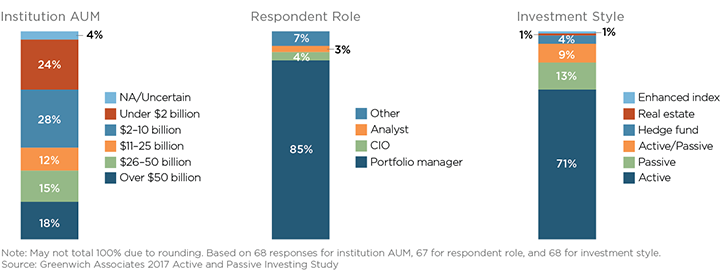

MethodologyFrom March to May 2017, Greenwich Associates interviewed 68 portfolio managers, chief investment officers and analysts at asset management companies across the United States, Europe and Asia. Interviews consisted of a series of quantitative and qualitative questions regarding the current challenges facing the industry and competitive strategies for client retention and fund performance against broad market benchmarks. This research was commissioned by FactSet.