Alternative data has been around for at least a decade, but an increase in adoption is making it less “alternative” and a more essential part of portfolio construction. The word is out that these new, unique data sources can add valuable explanatory power to both quantitative and fundamental investment models. Intuitively, investors now understand that alternative data strategies can yield important information. Tracking shipping data, for instance, may offer intelligence about trade flows and corporate performance, measuring foot traffic at shopping malls can inform retail sales forecasts, and vehicle registration data can provide early insight into the automotive sector.

Until recently, the usage of alternative data has been confined mainly to the realm of quantitative investment managers, as these firms were best able to obtain, clean and process this data. Now, however, alternative data is beginning to go mainstream, with increasing interest from fundamental and hybrid asset managers. More traditional financial information vendors are expanding into this market and developing offerings tailored to this new segment.

In this Greenwich Report, we will look into some of the recent trends in the adoption of alternative data and demystify its usage by taking a deep dive into how shipping data can help chart a course for alpha.

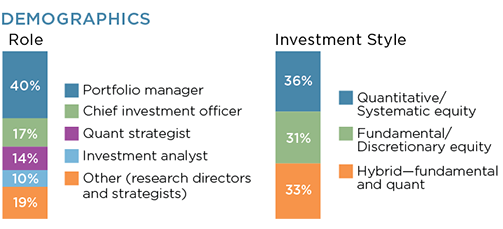

MethodologyBetween December 2018 and February 2019, Greenwich Associates interviewed 42 investment specialists at quantitative, fundamental and hybrid asset management companies. Respondents were asked a series of questions about their usage of alternative datasets.