Table of Contents

With the initial liquidity shock of COVID-19 waning, many large companies and banks in Asia have sharpened their focus on treasury operations, in line with the emergence of new business models and faster digitalization spawned by the pandemic, according to several corporate treasury experts.

They were speaking at a virtual panel discussion hosted by CRISIL Coalition Greenwich on December 8, 2020, titled Asian Corporate Cash Management: Impact of COVID-19. The event was moderated by Gaurav Arora, Head of APAC & Middle East at Coalition Greenwich.

Back in March 2020, when COVID-19 cases began increasing, corporate treasuries and banks moved swiftly to shore up short-term liquidity. They adjusted their cash management processes for a work-from-home environment to ensure business continuity amid unprecedented operational disruptions.

Two quarters later, nearly a third of large Asian companies participating in the Greenwich Associates 2020 Global Large Corporate Cash Management Study have reported that their business has returned to a neutral stage in Q4 2020, compared with just 16% in Q2.

However, as of Q4, 57% of respondents said their business was still being negatively to highly negatively impacted, compared to 78% in Q2.

As Stability Returns, Focus Shifts from Liquidity

The sentiment has improved over the past two quarters, as economic activity in some markets, including Taiwan and China, recovered faster. Moreover, as the panelists pointed out, the apprehensions around liquidity have abated, with banks and governments providing emergency support.

Companies have drawn down revolving credit facilities or issued bonds to build liquidity—for working capital, as a buffer or, in sectors such as tourism, to buy time until business models can be reconfigured.

Today, companies are planning for six to nine months of liquidity, compared with three to six months earlier in the year, according to Mahesh Kini, Head of Cash Management, Asia Pacific at BNP Paribas.

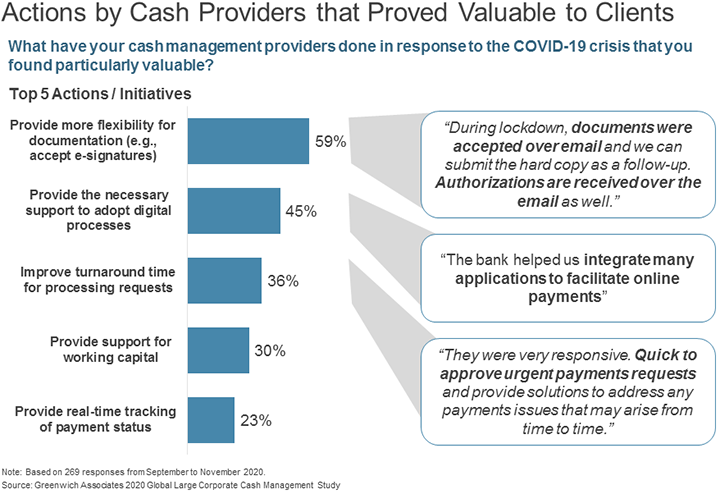

That apart, cash management providers have supported corporate treasuries by offering flexibility in documentation, digital KYC, real-time tracking of payments, and in the adoption of digital solutions.

More Digitalized and Innovative Business Models

As a result, many companies are graduating from what Coalition Greenwich calls the initial “react” phase of the crisis to the “respond” phase, where they are revisiting business models. A few are even moving to the “reinvent” phase, as they adapt to the new normal.

COVID-19 is thus triggering more digitalized and innovative business models, said Sridhar Kanthadai, Head of Wholesale Payments, Asia-Pacific at J.P. Morgan.

For instance, conventional tire companies are looking at a pay-per-mile subscription model instead of outright sales in some markets, which has implications on transaction volumes and values, and therefore, on cash management.

Mark Troutman, Group Head of Sales, Global Transaction Services, DBS Bank, pointed out that treasurers have been proactive in responding to the needs of their businesses to introduce/expand digital customer payment options citing OEM car dealers in Singapore bypassing cheque payments for direct scan-and-pay options, and work with a Chinese company using application programming interface (API) connectivity for contactless transactions with distributors to increase business volumes.

To be sure, Asia-Pacific already accounts for around 50% of global e-commerce volumes, yet the pandemic has further accelerated digitalization of business models. Nothing exemplifies this hastened transition more than luxury brands, the epitome of touch-and-feel shopping. Most of them have rushed to set up e-commerce portals, according to Mahesh Kini.

More Meaningful Digitalization

Treasuries and companies are also transitioning from the initial electronification of manual processes to more meaningful digitalization. As more data becomes available—at ever-increasing speeds and frequency—the ability to aggregate them and draw actionable insights will be crucial for real-time treasury operations.

Mark Troutman believes there is greater awareness now among treasury ecosystems about the potential impact of digitalization.

The ongoing crisis is also prompting banks to re-architect digital solutions that were designed in isolation into holistic value propositions covering the entire lifecycle—from on-boarding, transactions and execution to reporting, analytics and customer service, according to Sridhar Kanthadai.

A key challenge here is that most companies do business with multiple banks, and each bank may have only a sliver of a company’s data. Nevertheless, the possibilities are exciting, was the refrain.

In Singapore, for instance, financial institutions could tap the government’s MyInfo database for contactless supplier onboarding. They could even use this along with third-party data to design alternative lending models for a geographically distributed supply chain, pointed out Mark Troutman.

BNP Paribas is collaborating with clients and fintech partners to co-create smart data applications for cash forecasting and reconciliation. J.P. Morgan is using artificial intelligence to detect cybersecurity breaches on all wire transactions.

Negotiating the New Normal

Undoubtedly, treasuries are still some time away from using real-time data, but the increasing use of APIs can be a significant enabler, experts say. However, not all real-time data may have value, and companies and banks will have to evolve practical use cases.

So how should companies navigate the crisis from here on?

Sridhar Kanthadai urges corporate treasuries to embrace digitalization for impactful change. Mark Troutman advocates companies conserve cash and enhance supply chain diversity and resilience.

Corporates and cash providers must also continue to have dialogues and share ideas in order to negotiate the new normal as smoothly as possible, said Mahesh Kini.