Table of Contents

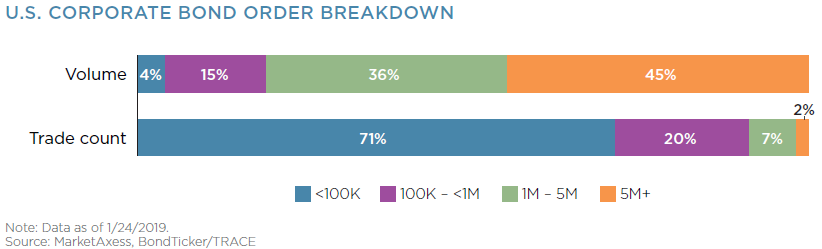

On any given day in the U.S. corporate bond market, roughly 70% of the trades executed are for 100 bonds or fewer (equivalent to $100,000 or less). Greenwich Associates data shows that the vast majority of these trades—over 90%—are now done on electronic trading platforms. However, while this data appears to paint a picture of a very efficient and electronified market, the full story is more complex.

That 70% of trades accounts for only 3–4% of the total value traded on an average day. Conversely, trades of 1,000 bonds ($1,000,000) or more, which account for just 8% of trade tickets, make up over 80% of the notional volume traded daily. And while our data shows that average trade sizes for electronically executed investment-grade corporate bond trades are now approaching $2 million, the level of e-trading quickly drops off as trade size increases. In fact, research we published in January 2019 noted that 82% of corporate bond investors found trades above $15 million in size “very difficult” to execute.

Electronifying Block Trading

To understand why this disparity exists and why electronifying block trading has been such a challenge, it is important to first understand how institutional-sized block trading works.

First, some obvious but important points: Asset managers and other buy-side firms buy bonds to hold them. Brokerdealers and other market makers buy (and sell) bonds to either facilitate client needs or to capture the bid-ask spread. There are always exceptions to the rule, but by and large, this is how the corporate bond market functions. And while the old adage that bonds are sold rather than bought might hold true for new issues, trading in the secondary market no longer follows this rule.

When an asset manager has $3 million of a single bond issue to sell, for example, they would ideally like to find another buy-side firm that needs to buy those same bonds. For both firms, the strategy may reflect changes—they have client redemption requests or they simply have different views on where that credit is headed. However, as has been well documented, the total number of corporate bonds available to trade in the U.S. alone is so large, and most of those bonds so illiquid, that the chances of finding a “natural” other side of a trade at an exact moment in time are slim at best.

For the better part of the last century, broker-dealers and other market makers have acted to rectify that mismatch. These middlemen were willing to buy from a client looking to sell, assuming that they would be able to eventually sell those same bonds to someone else at a higher price. That might take an hour or a day or a month, but these bond-dealing desks were built to profit from being a holding place for bonds waiting to be bought by another long-term investor.

Acting in this capacity, of course, requires money—money that the dealer reserves solely for buying those bonds until they find the natural other side. This worked well until the credit crisis of a decade ago, which made dealers rethink how they take on risk, what amount of risk they take, and how much capital they are willing to dedicate to this business. The result is well known: Increased capital requirements left dealers with less money to buy and hold bonds, leaving the buy side feeling that liquidity had dropped off a cliff.

Liquidity: The New Normal

In reality, the liquidity that the buy side became so accustomed to was a mirage. Dealers didn’t really want those bonds—they were simply taking a calculated risk that they would be able to sell them later. When that changed, the buy side was left looking for more natural liquidity. And as the past five years has taught us, that Holy Grail is only sporadically unearthed.

Nevertheless, the buy side’s perception of trading difficulty has improved considerably over this period. Technology has managed to solve the intermediary problem by allowing many more buyers and sellers—regardless of their firm types—to find one another. Request for quote (RFQ), while imperfect, has stood the test of time, and all-to-all trading has proven its worth and viability over the past five years. But back to our original point: Block traders continue to struggle.

New Hope for Block Trades

There is, however, hope in the form of regulatory proposals, innovative ideas and technology, such as artificial intelligence and machine learning. Improved data mining by market participants, trading venues and some third parties have augmented corporate bond-dealing desks’ capabilities by helping those traders connect the dots in ways that would have otherwise remained elusive. It’s not always easy for a trader to remember a single phone call four months ago, for instance, on which a client expressed interest in the same bond another client is asking for today.

New trading protocols are also making it easier for investors to trade a block of bonds across multiple liquidity providers. The decades-old, yet still effective RFQ process generally allows only one winner—meaning that each order can only see a single execution from a single counterparty. Allowing multiple counterparties to simultaneously buy pieces of a single large order brings more liquidity providers into the picture, while allowing the requestor to achieve a better execution more quickly.

Aggregating Trades Would Boost Liquidity

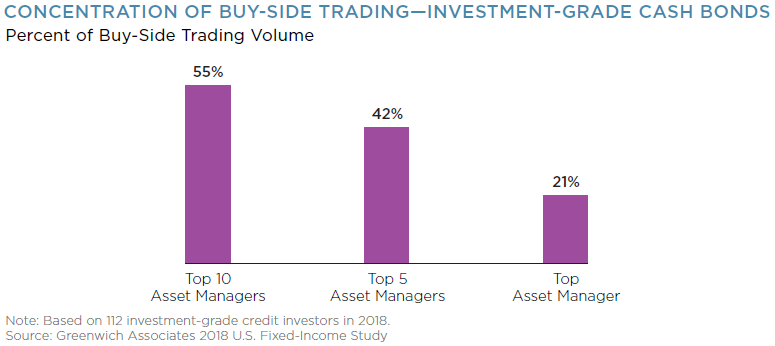

This whole idea becomes more effective as more of the market gets involved. Greenwich Associates data shows that the top five asset managers account for 42% of trading volume in investment-grade corporate bonds. It is not surprising, then, that the biggest bond dealers have narrowed their client lists to focus on these big fish, leaving smaller investors with less access to liquidity.

While this approach was logical following the financial crisis, going forward it amounts to leaving revenue on the table. Aggregating the activity of the smaller firms—those that account for the other 58% of market activity—could prove to be a huge source of natural liquidity, helping dealers to service their large clients via an amalgamation of many smaller ones.

Final Thoughts

Ultimately, as market trust of technological solutions for bond trading improves, willingness to execute higher value trades on the screen increases. While data and analytics used for pre-trade decision-making are still maturing (less than 40% of fixed-income investors use TCA), dealers and investors continue to evaluate their worth.

These solutions must also continue to foster human relationships and trust—something still very much at the center of efficient markets. Bond dealers and their balance sheets remain a crucial element to the market’s proper functioning, even as the ways in which they provide their services evolve. So while the low-hanging fruit of corporate bond e-trading has been picked over the past few years, expect a big push to get the biggest and ripest fruit off the top of the tree in the years to come.