As U.S. small businesses and middle market companies shift gears from pandemic-era survival to post-COVID-19 growth, they are rewarding banks that stood by them during the crisis.

Among owners and executives of small businesses and middle market companies, optimism about the economy is nearing pre-COVID highs and commercial banks expect to capitalize on this resurgence to spur growth in loans and other revenue streams.

However, bankers are finding out that some consequences of the crisis are outlasting the economic lockdown. For example, more than one in five companies say they are at least considering shifting their business to their Paycheck Protection Program (PPP) loan provider.

The more than 500 companies participating in a recent Greenwich Market Pulse rank “valuing long-term relationships” as the number-one factor considered when assessing and selecting banks in volatile markets like 2020-2021.

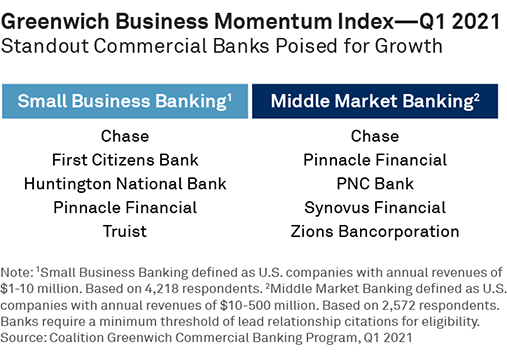

We are pleased to share those banks earning recognition by receiving the industry’s highest scores on the Q1 2021 Greenwich Business Momentum Index, which calculates a net score for each bank based on the number of small businesses and middle market companies reporting plans to increase or decrease business with the provider.

We welcome the opportunity to share additional information about how expectations and perceptions are changing in banking.