The goal of the FX Global Code (FXGC) is to “promote the integrity and effective functioning of the wholesale foreign exchange market.” The FXGC covers topics ranging from operations and workflow to trading and algorithms to risk management. While each of the topics is (or should be) of great interest to corporate end users, Coalition Greenwich research indicates that corporates have not embraced the FXGC. In fact, many corporations are unaware that there is an FXGC.

Benefits of the Global Code

Only 10% of corporates that participated in our research have or intend to sign onto the FXGC. For the minority of corporates who are adopting the code, they clearly see the benefits. The most frequently mentioned reasons for adoption are:

- Fostering a level playing field between corporates and their banks

- Ensuring corporates have high governance standards

These two reasons are central to the adoption of the Code. It is designed to ensure fair outcomes for all market participants. This includes both liquidity providers (mainly banks) and liquidity takers (in this scenario, corporates). Moreover, one of the key drivers behind the Code is to foster the highest governing standards across signatories. The reach of the benefits of the Code, however, does not yet extend deeply into the corporate world overall.

Lack of Awareness

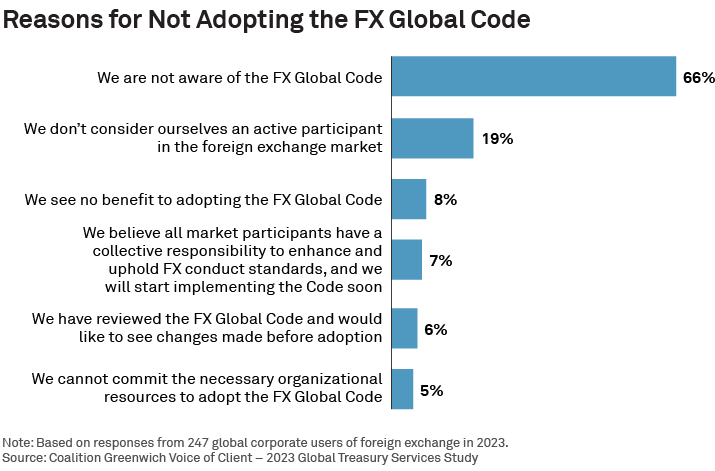

Corporate interest in the FXGC is limited, with 90% stating they have not adopted the Code. This is not necessarily due to the Code itself, but rather because 66% of those corporate end users are unaware of the Code’s existence.

Therefore, a key conclusion for any entity (be it a bank or an industry body) with a stake in extending adoption into the corporate space is to raise awareness of the Code’s existence and explain how it benefits the entire FX ecosystem, especially corporate clients.

Proponents of the Code know that they need to spend more time educating the buy side on its benefits. The Bank for Internal Settlements (BIS) recognizes this and has thus recommended educating on the three main areas of focus for the next review, stating, “Educating a broader set of market participants on the Code and increasing adoption should remain a key priority.”1

Even with that education, not all end users will feel like the Code pertains to them, but a lack of awareness of the FXGC as the main obstacle can be overcome.

Stephen Bruel and Tom Jacques are the authors of this publication.

1Markets Committee input into the upcoming review of the FX Global Code (bis.org)