Table of Contents

Commercial banks are redefining servicing models for small and midsize companies to prepare for the “new normal” era, as businesses return to work following the COVID-19 shutdown.

We have closely monitored banking client behaviors for more than 40 years, and the COVID-19 crisis has confirmed that businesses will continue to need their banks – and more importantly, their bankers, to help them navigate through this unprecedented environment.

The crisis has shown us that a new blend of servicing between traditional banker relationships and new digital tools will define the key drivers of client satisfaction in the COVID era.

Customers Look to Switch Banks – Money in Motion

One-third of small and midsize companies are considering switching banks due to their bank’s COVID-19 servicing failures, according to new data gathered by Greenwich Associates. This unprecedented figure is more than double pre-COVID norms.

Small and midsize business clients cite both a lack of loyalty and an inability to service their needs as reasons for the desire to change providers. Most – but not all – super-regional banks1 and regional banks2 are the clear winners in the scramble to service clients through the crisis. Many of these banks addressed current client needs and proactively contacted each client to address concerns.

“We touched every client by leveraging relationship managers, business bankers and branch managers. I couldn’t be more proud of how we handled those first few weeks of the crisis.” – Chief Operating Officer and Head of Commercial Banking for a regional bank

“I used to be satisfied with my bank – I had a long-term relationship with them and was a dedicated customer. I did all my business both personally and professionally with one bank. This bank did not help me with the PPP loan process. It was one of the banks that catered to the bigger clients only and left the small businesses blowing in the wind. I went to a small local bank where I had no relationship established and they started helping me with the process. I am getting the loan thanks to them!” – $10-50MM Middle Market Banking Client

New Era Servicing

The COVID-19 crisis has laid bare the need to service business clients through a blended delivery model. The financial services industry has grappled with the need to offer more digital banking options, streamline the credit process through digital channels and support a more omni-channel experience – all at the expense of traditional relationship manager engagement. It took only 60 days and a pandemic to learn we need both digital and engaged bankers to meet our clients’ needs.

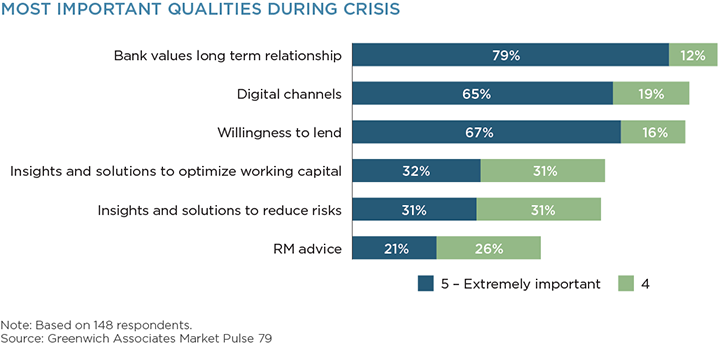

We developed a Greenwich Crisis Response Index (CRI) to confirm the most important qualities in the new COVID era of bank servicing. Three key differentiators of service that stood apart for commercial banking customers are 1) prioritizing long-term commitment, 2) digital channels and 3) willingness to lend, following the SBA’s Paycheck Protection Program (PPP).

Valuing Relationships

Prior to the COVID era, small and middle market business decision-makers were primarily focused on the advice and guidance of their commercial relationship manager. That all changed during the crisis, with the fundamental focus shifting to liquidity and survival for many businesses.

Client sentiment is that larger, national banks attempted to centralize the process during the crisis and remove the relationship manager as the primary point of contact. This has reduced the benefit of the long-standing partnership and changed the key differentiator to servicing commercial clients.

The Greenwich CRI shows that some larger banks were not as focused on their small and midsize customers. Most small businesses found banks ill-equipped to handle their PPP applications, propelling executives to seek out alternative providers better positioned to manage through the crisis. Volume pressure on larger banks is leading to a “spillover” effect, which may help smaller banks and alternative providers capture new business.

Digital Channels

As a result of the crisis, digital interactions have been bolstered in a way that will reshape banking behavior forever. Digital platforms and processes are essential amid social distancing and work from home (WFH) mandates. Also, transparency of the banking process portrayed through digital channels is now more important than ever, e.g., communicating the status of a loan by digitizing the credit process.

What business clients desire the most, post-crisis, is not the need for cutting-edge features and functionality but rather the ability to clearly follow their customer journey online.

Almost half of business clients told us that they have increased their interactions with their bank since the start of the crisis. The primary communication vehicles being used are digital banking and communicating with the relationship manager by email and phone.

Willingness to Lend after PPP

As business clients’ need for capital increases during the COVID era, banks’ ability to respond will lead to inevitable strains on existing relationships. Those banks that can address the liquidity bottleneck arising from the surge in SBA applications will retain clients and acquire new ones.

Over the next few months, unsatisfied commercial executives will likely seek out providers better suited to meet their needs. These servicing frustrations will reduce barriers to switching banks and lead to significant opportunities for aggressive banks and other providers.

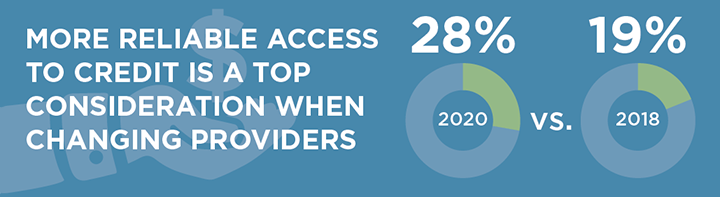

Between 2018 and 2020, the Greenwich CRI shows an almost 10 percentage point increase in business clients’ need for more reliable access to credit.

Banks that are better positioned to manage through this crisis and meet business clients’ credit needs will see a significant revenue opportunity. We call this “money in motion”: billions of dollars of revenue in play for business checking, bilateral credit and cash management opportunities.

Redefining U.S. Commercial Banking in the COVID Era

The COVID era has shown once again that banks must put clients first. Business clients are ready to leave their primary bank, with whom they’ve invested lengthy partnerships, to reinvent their relationships with banks that understand the need to blend servicing between traditional banker relationships and new digital tools.

The super-regional and regional banks were the clear winners during the crisis. Next is the endurance test during this time of money in motion that will define the true winners or losers.

Banks that can quickly redefine their servicing model to convey value in relationships, offer digital channels following the customer journey and a willingness to lend after PPP will be well-positioned to succeed in the “new normal.”

Footnotes:

1Super-regional banks are those ranked fourth through twentieth in asset size.

2Regional banks are those ranked twenty-first through fiftieth in asset size.