The U.S. Securities and Exchange Commission (SEC) continues to shake up the crypto industry with its recent string of enforcement actions. There are major implications for institutional traders as the regulatory status of digital assets and platforms becomes the topic of the day. Activity is frenetic as assets are delisted, new platforms launch, existing platforms carve their niche, and policymakers hold hearings and draft bills.

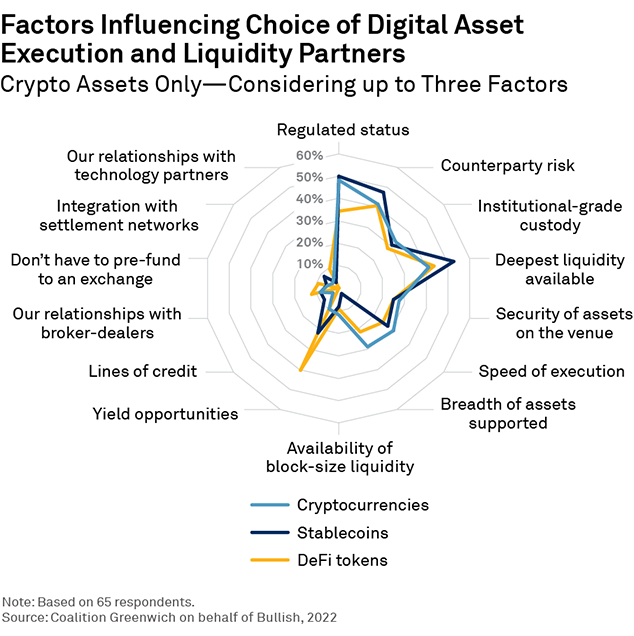

What feels lost in this discussion of regulatory uncertainty, however, is what institutions that are actually trading in the market truly value. Coalition Greenwich research1 reveals the top five factors2 that institutions managing digital assets value most from an execution and liquidity partner perspective:

- Deepest liquidity available

- Regulated status (venue/partner)

- Counterparty risk

- Speed of execution

- Breadth of assets supported

While all are important and part of an overall package, it is telling that among those managing digital assets today, deepest liquidity available beats regulatory status as the primary factor when selecting digital asset execution/liquidity partners. This clearly demonstrates that despite the noise, institutions continue to value liquidity and that regulatory status is not the be-all and end-all, even with significant market structure shifts and recent uncertainty.3

Choice of investment strategy also influences what traders value. It is estimated that only about 50 tokens in the world are liquid enough for institutions beyond buy-and-hold, venture capital (VC) or long-only strategies. In addition, according to blockchain and crypto asset data company Amberdata, statistical arbitrage remains a key strategy for many digital asset investors and will continue to attract investment dollars.

While the last few months have given us a clearer view of where crypto market structure is headed in the U.S., particularly in light of the Coinbase and Binance enforcement actions, it is important to revisit how we got to this point—especially before we project where we are headed and what institutional traders (including those in the U.S.) will value going forward.

U.S.—How We Got Here

Much of crypto investing in the U.S. evolved in a process where VCs, family offices, hedge funds, and other high-net-worth (HNW) individuals made direct investments. Retail investors, however, have faced roadblocks investing in digital assets through traditional firms, with many accounts unable to hold these instruments (e.g., 401(k)’s) and financial advisors not willing or able to buy them on behalf of their clients.

As a result, we believe there is pent-up demand for exchange-traded funds (ETFs) and other investment vehicles that solve for the custody and security concerns of retail investors. Nevertheless, digital asset ETFs have not emerged on major retail platforms in the U.S. (beyond thematic ETFs). The reasoning for a lack of registered products available to retail investors is as follows:

- We don’t have a spot (as opposed to futures-based) ETF for digital assets approved in the U.S. – A spot ETF would invest in digital assets directly instead of through futures contracts. We do not have a spot ETF approved yet, in our view, because we don’t have a regulated market for the two most significant crypto assets in the U.S. (Bitcoin and Ether) outside of futures. In addition, while the Blackrock ETF announcement suggests we may be closer to having one approved (alongside Fidelity, WisdomTree, Bitwise, Invesco, and Valkyrie), we have seen several failed attempts so far, and it is not clear anyone will ultimately get this approval (at least in 2023).

- We don’t have a regulated market for spot in the U.S. for digital assets – Thus far, we only have two FINRA-approved, special-purpose broker-dealer/alternative trading systems (ATSs) for digital asset securities (Bosonic Securities and Prometheum4), which cannot yet trade the most-liquid crypto assets. Moreover, we also do not have any national exchanges such as ICE or Nasdaq (though EDX5 may have the intention to become one in the long run). Crossover Markets offers exchange-like functionality (a CLOB for crypto pairs), but is not an exchange or ATS in the U.S.

- We don’t have ATSs and/or exchanges for the most-liquid digital assets – Why? Because the tokens that have been issued thus far have limited means to come into compliance as securities to trade on an ATS through a registration process with the SEC. Some token backers believe they are commodities, and others believe they are none of the above. Others are simply waiting and eying the Ripple case.6

The net result is that outside of futures, the vast majority of crypto in the U.S. cannot trade in a regulated market (we only have limited digital asset securities that can trade on ATSs). The market is simply stuck as we move through this market structure shift and regulators and policymakers are active.

What Regulators are Doing

Back in the fall of 2022, the various agencies began challenging the intermediaries in the sector to come into compliance and sought to limit the perceived impact of the crypto sector on traditional banking. We observed a series of steps:

- Step 1 was to challenge the way the crypto banking sector in the U.S. worked to avoid potential spillovers into traditional banking. In other words, if U.S. banks were not exposed to crypto, then crypto couldn’t hurt the banking system.

- Step 2 was to examine whether digital assets could come into compliance or else support the de-platforming of some of these assets. If the riskiest of digital assets were not able to trade, the risk they could potentially pose to the overall system would be reduced (or redirected elsewhere).

The next logical steps are then as follows:

- Step 3 is to bring as many individual tokens into compliance with U.S. securities laws as possible, which can later be made available for trading on exchanges and ATSs (alongside other registered digital asset securities). Some of the tokens could later be deemed digital commodities as well, which would place them under the CFTC’s jurisdiction.

- Step 4 will be for national exchanges and/or ATSs to support primary issuance, disclosure regimens, secondary trading, market surveillance, and anti-fraud services, as well as data/news to support investors. But this still feels some years away.

There is one caveat—some of the tokens may never come into compliance (or just a few of the biggest ones could) and thus, the majority of trading would continue to take place outside the U.S. on platforms that are not U.S. exchanges or ATSs. However, should a policy shift take place that brings these tokens into compliance with U.S. rules, spot liquidity could return in the U.S. Or, if they are deemed commodities, as some legislators clearly prefer, the futures markets might become the center of gravity (where CBOE Digital has just been approved for margin trading, for example).

What This Means for Institutions

Based on these steps, we believe that crypto has been put on a new path in the U.S. and that, barring a major change in the policy and oversight environment, significant long-term changes are being made that will have far-reaching implications.

Based on where we are in the U.S., we believe the following scenario to be the most likely:

- The majority of spot crypto liquidity for institutions will remain outside the U.S. Crypto liquidity will mostly evolve elsewhere, especially on non-U.S. platforms and decentralized exchanges (DeXs) like Uniswap,7 continuing a trend we have recognized for well over a year. It will remain a fragmented market.8 Order books with regulatory status in other locations like Singapore, UAE, Switzerland, and Gibraltar will become relatively attractive.

- Derivatives volumes on CME, CBOE Digital and Coinbase will grow on a relative basis for U.S. institutions. Some firms will utilize perpetual swaps (‘perps’) outside the U.S., while others will take advantage of the leverage inherent in margin trading on CBOE Digital or on Coinbase’s perps exchange. Futures markets are a tidy solution for mitigating liquidity risk, counterparty risk, and clearing and settlement risks. But while derivatives can offer liquidity, the underlying crypto market must still grow concurrently to ensure a healthy market ecosystem in the U.S. over the long term.

- Custodians will continue to offer digital asset support of the major tokens but will have difficulty supporting the ever-exploding range of assets and requests by investors in the U.S. For the time being, the leading digital asset custodians in the U.S. will be the crypto-native firms such as Anchorage Digital, Etana, BitGo, Paxos, Gemini, Fireblocks, Coinbase Custody, as well as Fidelity Digital Assets. Capital requirements and SAB 1219 are putting severe pressure on the economics of traditional players offering their own custody services in the U.S, with Nasdaq recently backing away from custody and other banks focusing outside the U.S.

- ETFs, if approved, would be a critical game-changer for U.S. retail markets and solve for many of the issues of retail and HNW investors. The recent applications by BlackRock and Fidelity have left many feeling spot Bitcoin ETFs are almost here. Their approval would certainly be a game changer, but we’re not getting ahead of ourselves.

Looking Ahead

Institutional traders want liquidity above other factors, a point that has thus far been absent in the regulatory debate. And much of the future of U.S. market structure may rest on the final version of the McHenry bill (that proposes a “statutory framework” for digital asset regulation), the U.S. Senate and even a potential change in administration. The SEC and CFTC will certainly play their part in the future of digital assets in the U.S. as well, but a change in the law will have a bigger long-term effect.

In the medium term, institutions are finding ways to increase exposure to crypto/digital assets, albeit in less liquid and roundabout ways (moving operations to Dubai, Singapore, etc.). The smart players are amassing technology solutions to position themselves for the day when regulatory leaders and legislators provide rules of the road for this asset class. The need for a long-term solution via concrete rules of the road is the one thing everyone agrees upon.

1In an effort to better understand the current and future state of institutional digital asset investing in late 2022, Coalition Greenwich conducted an independent study on behalf of Bullish exploring how investment firms managing or planning to manage digital assets are seeking liquidity. 2Security of assets on the venue (if applicable) is also a key factor, but depends on whether the venue requires pre-funding. 3One example is the ongoing withdrawal of Binance staff and operations in the U.S. as well as Grayscale and Coinbase engaged in lawsuits. 4According to the CEO, “Prometheum's affiliated companies are registered with the SEC and are FINRA members. Specifically, Prometheum ATS is an SEC-registered ATS that matches orders for buyers and sellers of digital assets securities (DAS) under the Federal Securities Laws (FSL). Prometheum Capital, also a SEC-registered and FINRA member broker-dealer was recently approved to operate as a special-purpose broker-dealer, meaning it is the first SEC-registered custodian for DAS under the FSLs.”5EDX is not an exchange and today only supports trading for assets that are most likely not securities in the U.S. 6Moreover, in our opinion, even less-liquid crypto assets (e.g., Algorand, Solana) have limited means at present to come into compliance as securities in the U.S. due to their decentralized nature, governance structure and/or possible desire to remain outside of this category for the time being. 7We do not see Uniswap or any other DeX registering in the U.S. 8For instance, Amberdata collects data from 27 exchanges (including 16 spot and 11 futures/options/swaps. 9Securities & Exchange Commission Staff Accounting Bulletin 121.