Table of Contents

Trade finance may have been a latecomer to the digitalization party, but its growing adoption, along with companies’ increased thrust on improving environmental, social and governance (ESG) compliance, presents a real opportunity for banks in Europe to reinvent their trade finance operations in sync with the changing demands of their largest customers.

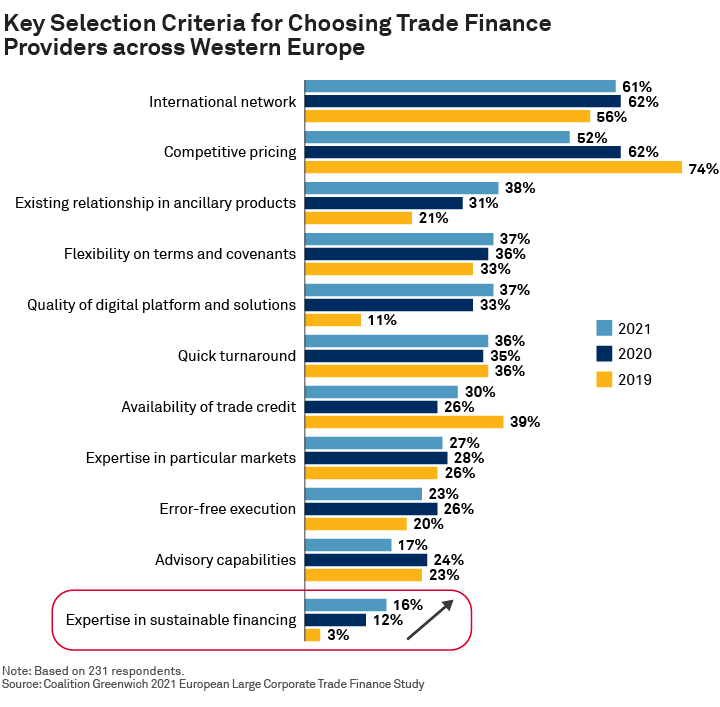

Our views are based on data from the Coalition Greenwich 2021 European Large Corporate Trade Finance Study, which shows that 37% of large companies interviewed across Western Europe cited the quality of digital platforms and solutions as a key criterion for choosing banking partners for trade finance in 2021, as compared to just 11% in 2019.

This is one of the biggest changes that we’ve seen over the last three years in terms of the preference criteria for choosing trade finance partners.

Moreover, expertise in sustainable financing is five times more important for corporates selecting a trade finance provider today than it was in 2019.

Digitalization to Help Enhance Customer Service and Flexibility of Solutions

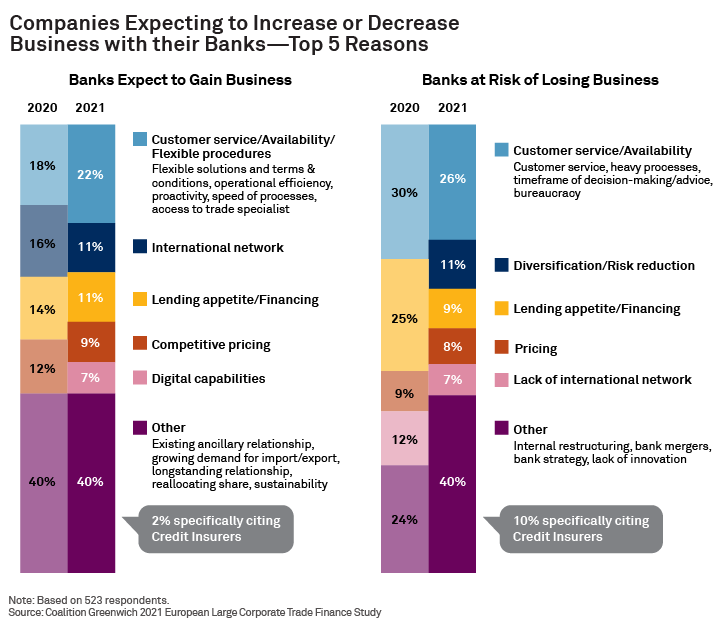

Among corporates in the study, 22% said that customer service in terms of operational efficiencies and timeliness, availability of flexible trade finance solutions and procedures, and access to trade specialists are the key reasons for increasing their business with banks. Seven percent of corporates added digital capabilities to this list.

We would argue that digital capabilities can really help provide and make those customer service experiences stronger, enhance advisory capabilities and make procedures more flexible, reducing the heavy processes that are currently one of the main factors that might lead clients to move away from certain banks.

For now, digitalization of trade finance in Western Europe is still at an early stage, with corporate banks’ digital trade-finance capabilities varying widely and only 18% of them offering best-in-breed functionalities, according to the Coalition Greenwich 2021 Digital Benchmarking Program report.

Banking leaders that are innovating continuously, however, are going beyond merely automating manual processes to making them smarter. This can help free up client-service professionals to provide more value-added services that will, in turn, help banks capture a higher share of wallet.

Also, since two-thirds of the companies in the study use the same bank for trade finance and foreign exchange, digitally integrating the two can also trigger a cross-selling opportunity for banks.

Trade Finance Providers Can Help Corporates Meet ESG Targets

The growing thrust on ESG is evident from the fact that 75% of corporates interviewed have already set ESG targets in the current year.

When asked about the immediate- to long-term challenges to their business, 17% expressed a need to reassess their supply-chain management in light of raw material shortages, rising prices and supply delays, post-COVID. And 10% called out the growing pressure to implement ESG all-round, from employees and consumers to investors and regulators.

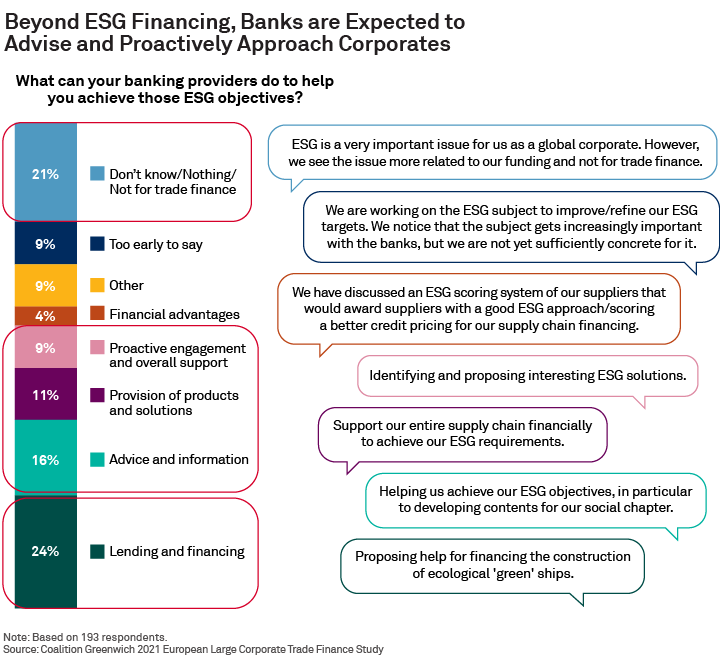

However, while one-fifth of the corporates in the study don’t yet see trade finance as a solution that will help them meet ESG targets, a quarter of them are looking to banks to provide green financing.

Moreover, over a third of corporates expect banks to proactively support them with appropriate products, advice and information through their ESG journey. They’re seeking intelligent information on how sustainable finance can help their business, such as better pricing on funding, relevant updates on the fast-changing regulatory environment, and also help in establishing key indicators of ESG performance, among other things.

We’re seeing some opportunities for banks to deepen their relationships by proactively educating and helping corporates understand how ESG can be applied to trade finance.

Similarly, companies want banks to roll out ESG standards and policies throughout the supply chain. Banks can help them reassess their supply-chain management from an ESG angle. They now have a role to make sure that Tier 2 and even Tier 3 vendors are ESG compliant.

Methodology

Between April and July 2021, Coalition Greenwich conducted 523 interviews with corporates with annual revenues of €500 million or more across Austria, Belgium, France, Germany, Ireland, Italy, Luxembourg, the Netherlands, Nordic countries, Portugal, Spain, and the United Kingdom. Interview topics included product demand, quality of coverage and capabilities specific to trade finance. Due to the COVID-19 pandemic, most personal interviews were conducted over the telephone.