The role of environmental, social, and governance (ESG) factors in investment decision-making has generated both positive and negative publicity. Fixed-income portfolio managers have indicated that ESG is a factor in their investment decision-making—but not the main one.

Coalition Greenwich research confirmed that considerations such as yield, return, and liquidity remain considerably more important than the ESG credentials of an issuer or issuance. (For a deeper discussion, please see The Continued Maturation of Fixed-Income ESG Investing).

For example, none of the portfolio managers participating in our recent study found that ESG is a primary or secondary consideration when making an investment decision. However, these same respondents anticipate that ESG will rise in importance over time. It won’t unseat the main factors of yield, return and liquidity—but it will matter more. And with this focus comes the need to source and consume accurate data to best manage the ESG implications of an investment strategy. (For more details, please see Expanding ESG Capabilities: Improving Data to Advance the Journey.)

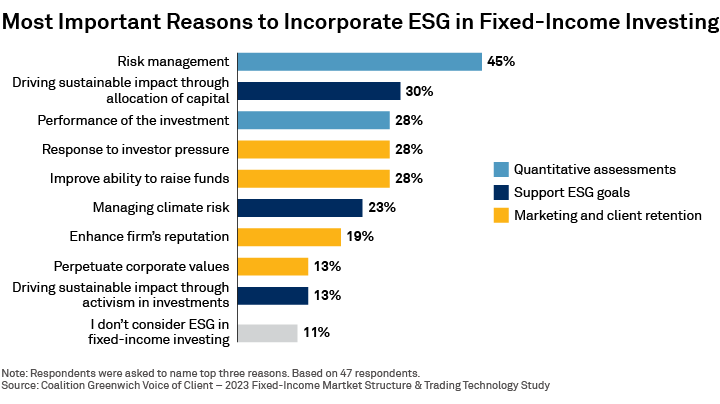

While ESG is lower on the list of factors, 89% of portfolio managers do consider ESG for a variety of (sometimes overlapping) reasons, including risk management, sustainability goals, and client retention and growth. There can be value judgments embedded into these decisions, such as for those who want to enhance their firm’s reputation and believe using ESG-friendly securities will help achieve that. However, quantitative factors are more important in driving the incorporation of ESG.

Risk Management

The most frequently cited motivation to include ESG in investment decision-making is risk management. There are many risks within ESG, such as regulatory and reputational risks. All risks within this broad category are important, but managers—whether they have an ESG focus or not—also seek to quantify the risk of an investment and ensure proper compensation for that risk via asset performance. Risk management in fixed income primarily focuses on financial risks, for example duration and interest-rate risk.

Default risk is also important to fixed-income managers, with much time and effort put into determining what could prevent an issuer from not meeting their obligations. Has the entity issued too much debt? Where does a particular issuance lie in the capital structure? Will rising interest rates hurt their ability to pay?

So where does ESG fit in? Models need to account for the potential impact of fires, extreme weather or other climate-related disasters, and the effect they could have on the ability of a corporation or municipality to service its debt. These climate scenarios need to be modeled just as one would evaluate the ability of any issuer to pay their obligations regardless of the cause. Given the uptick in natural disasters in the past decade, pricing in ESG risks is an exercise akin to pricing in other risks.

It is important to note, however, that although considered part of the ESG framework, this modeling exercise is simply another element required to evaluate and quantify the potential performance of an asset. It is not a value judgment meant to consider any societal benefit, despite the way ESG is often framed. It is prudent risk management.

On the other hand, the second most cited reason to incorporate ESG into the investing process is the desire to drive sustainable impact. Similarly, helping to mitigate climate risk through the allocation of capital was listed sixth. This is what many people associate with ESG investing—for instance, green bonds. Here, portfolio managers are making an investment determination not solely based on performance, but on other goals such as how their investments can benefit society (and with the hope that those benefits drive performance).

This is critically important for fund managers with an ESG-specific mandate. For traditional non-ESG fixed-income fund managers, however, ESG factors matter to help manage risk. Such managers are responsible for enhancing investor returns, and other considerations are secondary.

To that point, the popularity of utilizing ESG as a unifying principle of investing has been under pressure in recent months. The bond market has sold off over the past two years, and managers still must generate returns, suggesting that sustained performance is vital to the future of ESG investing. When markets go down, some investors may shift their focus to more quantifiable risks and away from values.

Nevertheless, the portfolio managers in our study continue to see the value of ESG factors for fixed-income investing. And while 2023 has seen its share of ESG controversies, investment dollars focused on environmental, social and governance metrics are still plentiful.

Conclusion

Looking forward, will prudent risk management or a new value system drive the fixed-income ESG market? Yes. And while these two drivers are often linked, they increasingly don’t have to be.

Including climate risk calculations in the portfolio construction process will become more common going forward, and green bond issuance might also continue to rise. These trends are in distinct is many ways, but the common thread bringing both together is the importance of ESG data.

Stephen Bruel is the author of this publication.