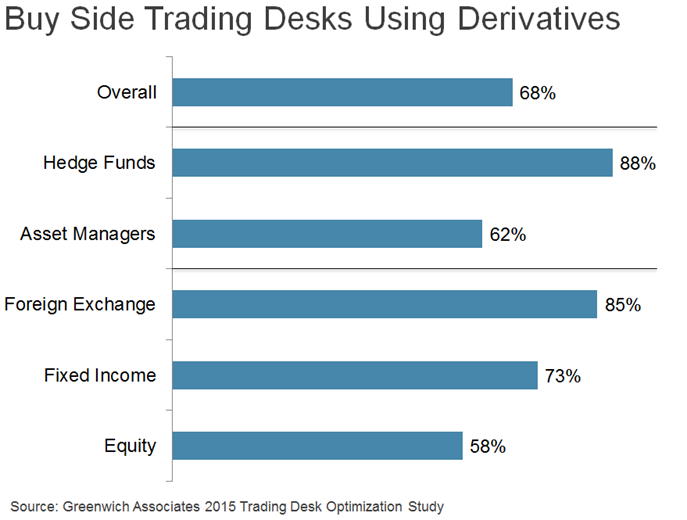

From a fund type perspective, it should come as no surprise that hedge funds - nearly 90% of those in our study - use derivatives, above the roughly 60% of asset managers that do the same. Their leveraged approach to investing coupled with less stringent investment mandates leaves them as prime candidates for swaps, futures, options and more.

Derivatives are a critical tool for investors. Whether providing a cost effective hedge, or leveraged exposure, they ultimately reduce costs and in some cases downside risks for asset owners. We conducted over 200 interviews with institutional investors around the world and found that more buy side FX traders use derivatives than those focused on other asset classes. The widespread use of forwards in the FX market are likely the main culprit, allowing those funds to manage their cash flows by locking in an FX rate a few days into the future. Fixed income traders were next on the list, with a lean towards interest rate products over credit. Interest rate swaps and futures are some of the most liquid instruments in the world, and are used to both hedge interest rate risk and take directional bets.

Nearly 60% of equity investors traded derivatives alongside their stock market trades, where single name equity options and index futures play a big role. While derivatives still have impressive penetration here, long only equity funds with mandates preventing the use of derivatives limits the trader from utilizing these instruments for hedging or exposure.