In our last blog post, we discussed our research showing that new tariffs from the Trump administration have impacted the businesses of 9 out of 10 global companies that do business in the United States, noting that many of these companies have decided to take a “wait and see” approach until the start-and-stop announcements on trade policy are resolved. That decision to hold off on any major strategic changes seems to have been a smart one in the short term, given the subsequent announcement of a major rollback in tariffs on China.

However, even with China tariffs reduced to “only” 30% for the 90-day negotiating period, companies cannot ignore a potentially monumental restructuring of the global trade framework for long. Indeed, companies around the world are in the process of planning out how they will react to the new trade rules, and, in some cases, they are moving ahead and implementing their strategic responses.

Shifting supply chains, price adjustments and other strategies

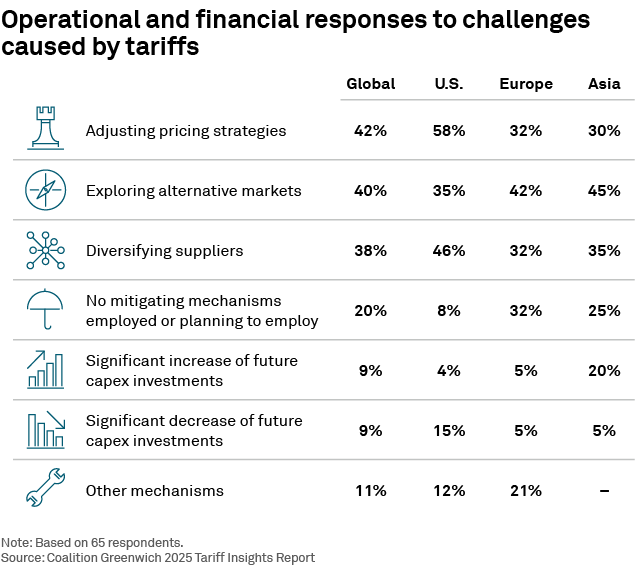

Some of these responses seem to be in line with Trump administration goals. For example, nearly half (46%) of U.S. companies say they are diversifying suppliers, or drawing up plans to do so, presumably to lower exposure to China (and potentially to other Asian countries like Vietnam, which have also been subject to steep tariffs that were subsequently “paused” for 90 days).

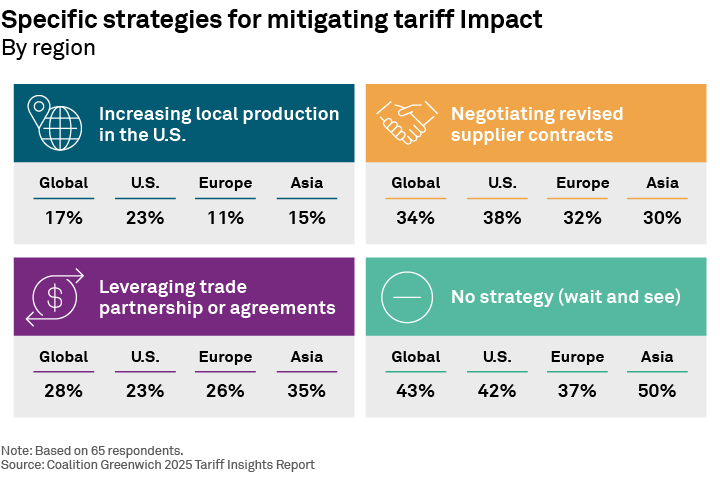

Approximately one-quarter of large U.S. companies say they are increasing local production in the U.S. or planning to do so. Meanwhile, 38% of U.S. companies (along with about 1 in 3 companies in Europe and Asia) say they are reaching out or planning to reach out to suppliers to renegotiate contracts, presumably to ask suppliers to absorb some new tariff costs.

Other moves by global companies seem much less constructive to the U.S. economy and Trump administration goals. For example, more than 40% of European companies with business in the U.S. and 45% of their counterparts in Asia say they are actively exploring alternative markets for their goods in response to U.S. tariffs or planning to do so. Only 11% of large European companies with business in the U.S. and 15% of Asian companies with U.S. market exposure say they are shifting production to the U.S. or planning to do so in response to tariffs.

In the U.S., 58% of large companies say they are implementing or planning price adjustments, implying they intend to pass along at least some tariff costs to customers. About 30% of Asian and European companies with U.S. exposure are likewise implementing or planning price adjustments. More than 1 in 10 large U.S. companies (15%) say they are implementing or planning significant reductions in future capex investments in response to the new tariffs.