Table of Contents

Coalition Greenwich recently partnered with Google Cloud to conduct research examining how cloud and artificial intelligence and machine learning (AI/ML) are powering market data distribution and consumption in institutional capital markets.

From March to April 2021, we interviewed 102 executives across the United States, Canada, France, Germany, Italy, the Netherlands, Switzerland, and the United Kingdom. Senior decision-makers at institutional asset managers, hedge funds, alternative investment managers, exchanges, trading systems, information providers, and information aggregators provided key insights. The research encompasses a wide range of perspectives from firms of different sizes and asset-classes, including equity, fixed income, FX, commodities, and multi-asset.

Dramatic Shifts in the Adoption of Cloud

The results demonstrate dramatic shifts in the adoption of cloud across market data producers and consumers, and evidence of further proliferation of cloud-based services across the trading and investing lifecycle. Moreover, there is evidence for the acceleration of public cloud for internal data insights across institutions.

A significant amount of study data and research support each of the five major takeaways of the study:

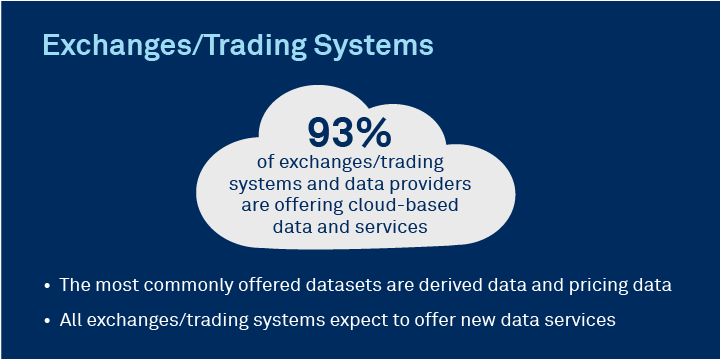

1. Cloud services are becoming ubiquitous for market data delivery by institutions.

Ninety-three percent of exchanges, trading systems and data providers we interviewed are offering cloud-based data and services.

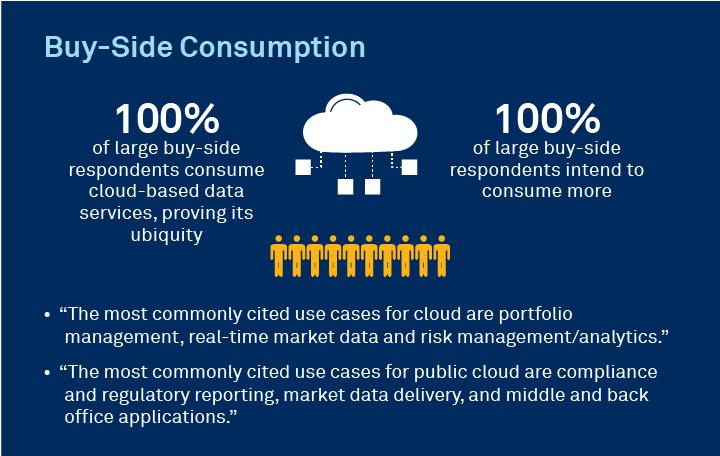

2. Buy-side firms have almost universally adopted cloud for market data.

Ninety percent of the total buy side (and 100% of large buy-side firms) we interviewed consumes cloud-based data today across functions such as portfolio management, trade-order management and real-time market data.

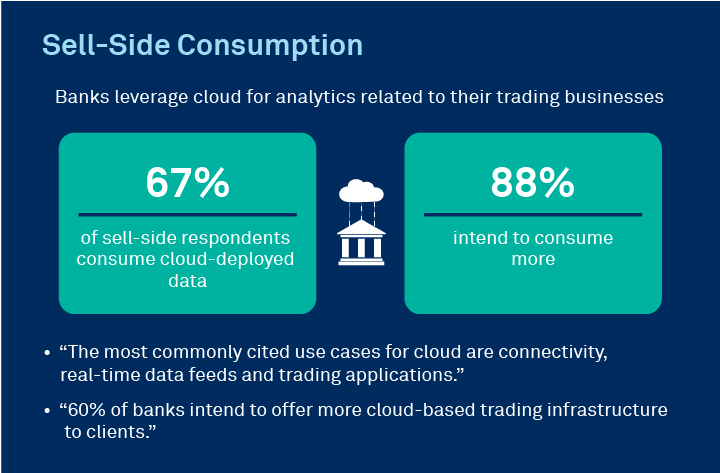

3. Investment banks are leveraging cloud for analytics related to their trading businesses.

Sixty-seven percent of the sell side consumes cloud-deployed data and 88% intend to consume more.

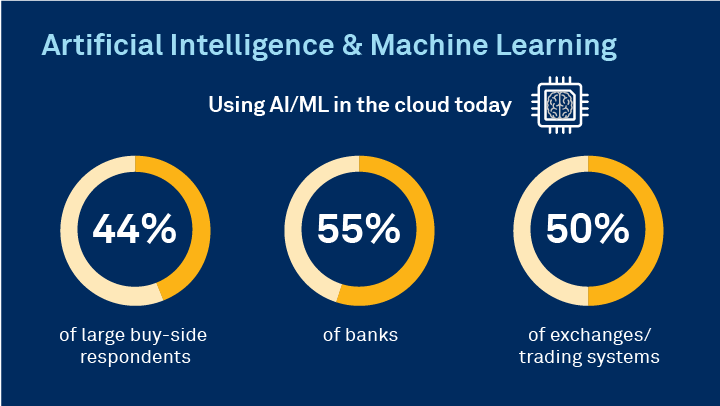

4. AI/ML, powered by cloud, is supporting delivery of data services by 50% of the institutions we interviewed at exchanges, trading systems and data providers.

Moreover, 44% of large buy-side firms and 55% of the sell side are using AI/ML in the cloud today.

5. Public cloud-based services are widely adopted, with 68% of combined sell-side and buy-side firms finding it critical for market-data providers to offer public cloud-based services.

And while institutions are widely adopting the cloud for market-data distribution and consumption, the research also points to further demand for public cloud. Exchanges, trading systems and data providers are prioritizing public cloud for internal data transformation and insights, though additional public cloud use cases are also forthcoming.

To learn more about this research, please go to the Google Cloud announcement here.

Also, for further insights on cloud and market data, watch our September 23rd webinar on Powering Market Data through Cloud and AI/ML. You can find out more and register for the event here.

Cloud Data Distribution and Consumption in Capital Markets