A sizable number of U.S. businesses are moving deposits in the wake of Silicon Valley Bank’s failure—a shift that could fundamentally redistribute deposits at a time when the banking system remains under pressure.

While First Citizens Bank’s acquisition of Silicon Valley Bank served as a lifeline, it may not be sufficient to recover the full faith of executives who may have been spooked by the speed at which regulators were forced to intervene. The recent bank failures have prompted small businesses and midsize companies to rethink what constitutes sound risk management when it comes to their banking relationships.

Continuing Implications for the Industry

Despite the fact that the vast majority of companies had no direct exposure to Silicon Valley Bank or Signature Bank, 15% of companies indicate that these recent events have eroded their confidence in their banks. In the weeks since, Credit Suisse has been absorbed by UBS, and JPMorgan Chase Chief Executive Jamie Dimon’s annual shareholder letter warned that this banking crisis is not yet over.

Executives and their banks are concurrently looking for safety in this period of continued uncertainty.

Risk Aversion Triggers Companies to Move Deposits and Diversify Banking Relationships

Although companies remain largely confident in their banks, the crisis had led executives to reassess how they manage counterparty risk and allocate bank deposits.

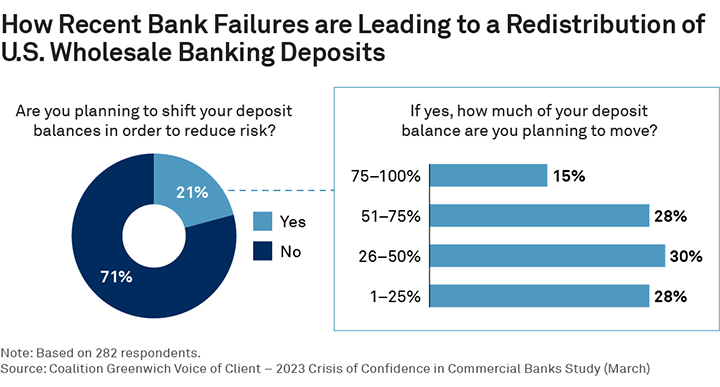

More than 1 in 5 companies participating in a special Coalition Greenwich flash study plan to shift bank deposit balances to reduce risk. These companies are looking to reallocate meaningful shares, with a majority expecting to shift a quarter of their funds. About 45% are planning to shift half or more. The crisis appears to have changed perceptions about risk and, in the future, some companies are likely to spread their deposit balances more widely as a prudent step for risk management.

Roughly 15% of middle market companies and about 1 in 10 small businesses have considered moving deposits from a local or small regional bank to a large regional or national provider. In our recent conversations with the largest national banks, the logistical realities of onboarding a spike in new relationships overnight were apparent.

To Build Trust, Bankers Must Get in Front of Their Clients

Companies shifting deposit balances in this uncertain environment are targeting new providers they view as strong and stable. How do business owners and executives judge the strength of competing bank brands?

In wholesale banking, there isn’t much advertising. To a large extent, a bank’s brand is conveyed by the relationship managers that represent the organization. To project stability and safety, banks need confident, capable bankers continuously engaging with clients. Data from our flash study shows that companies that have been proactively contacted by their bankers to discuss the recent industry events are twice as likely to say their trust in their banks has actually increased.

Despite the benefit of these conversations, less than half of companies say they have received any communication from their banks about the events at SVB or Signature Bank. About 1 in 5 companies have taken it upon themselves to reach out and schedule a meeting with their bankers or treasury specialists.

Banks have an important opportunity to shore up commercial banking relationships by meeting with clients and addressing any potential concerns. To this point, it appears many banks are missing what could be a limited opportunity to head off potential trouble by assuaging clients’ fears.

We advise bankers to get in front of clients on the phone, on Zoom and on the road—now. Not only can these conversations help protect deposit balances, they can also sustain growth by revealing needs among clients that can lead to deep relationships and new business.

Don Raftery, Chris McDonnell, Cheri Derrick, and Kevin Seiler are the authors of this publication.