“May you live in interesting times,” a translated curse, is certainly apropos to the U.S. commercial banking community over the last several years. The COVID-19 pandemic, bank failures and ongoing industry consolidation make now the optimal time to reflect on best practices demonstrated by top bank leadership teams.

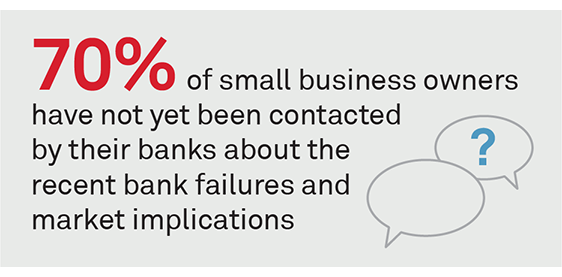

New data from Coalition Greenwich shows that 70% of small business owners have not yet been contacted by their banks about the recent bank failures and market implications, and nearly 20% of U.S. small businesses and midsize companies intend to switch their banks. This is nearly double the typical switching rate (11%) and points to the uneasiness executives are feeling in the wake of recent bank headlines. Uncertainty drives boards and management teams to reevaluate the potential risks associated with their current banking providers.

During the current crisis, banks need to embrace the reality of unintended consequences. Like the side effects of certain medications that often do not receive full consideration, the fastest rate hike in a generation by the Fed has created a number of risks—both seen and unseen. The unknown impact on consumer and business-owner confidence will play an important role on the severity and duration of any pending recession. Higher interest rates combined with increased economic risk clearly forces reexamination of credit underwriting risk tolerances.

The following recommendations can help banks to bolster confidence:

1. Management must be able to rapidly communicate at scale with: bank teammates, clients, prospects, centers of influence (lawyers, accountants, etc.), and the media

How do people want to consume information leading up to, during and shortly after a crisis?

- Twitter and other types of social media, email, calls by RMs/Mgt., visits, website, and financial media outlets are all viable channels. Audiences often need to hear the message from multiple sources multiple times before perceptions are changed.

- Sound bites need to be easy to consume, understand and share.

2. Reinforce key “table stakes” messages (again): financial stability, trustworthiness and the bank’s long-term partnership mentality

This crisis was triggered by the fastest rate hikes in a generation and a risk management “blind spot” at a small number of bank. Key takeaways are:

- Social media propels crises far faster today, and bank management teams will struggle to react quickly enough if firms do not have a playbook ready to execute.

- Fear spreads even faster in today’s environment, marked by a polarized political environment and rampant disinformation online.

- In the absence of trustworthy messaging, banks run a risk of trying to play catch-up with confusing, even conflicting storylines.

Mobile-application banking that became a “must have” for banks during the COVID-19 pandemic has made it particularly easy to move money quickly, placing a premium on speed and effectiveness for bank communications.

3. Top banks will be perceived as “safe harbors” and benefit during and post crisis: with bankers at the front lines of fostering these perceptions

Management teams need to reinforce accurate and positive stability perceptions of their banks before a crisis breaks out (e.g., financial stability is a hygiene factor in bank selection criteria).

Customers have moved significant deposits from banks perceived as risky to systemically important financial institutions (SIFIs) or “too big to fail” banks.

While large banks see inflows of deposits as customers look to open accounts, they are increasingly being more selective in the clients they want to bank with.

- “Client selectivity” has been a mantra for many institutions, but we expect it will be taken to a heightened level shortly by the largest banks as risk management rises in importance.

- Some commercial banking clients are also moving some of their money from bank deposits to higher-yielding, short-term options (money markets, T-bills, etc.), creating a double whammy for some midsize and smaller banks.

Employees at more vulnerable banks are also at risk of leaving, with many recruiters opportunistically targeting high-performing bankers to join their teams.

4. “Never let a good crisis go to waste.” Strong leaders are already seizing the opportunity presented by an adverse environment

Rare talent from banks impacted by the crisis have become available (e.g., SVB bankers deeply connected in the tech ecosystem).

Newly available data and enablement platforms allow RMs to leverage data to capitalize on fleeting opportunities for companies looking for safer partners.

Uncertainty continues to rattle the banking community but with clear lessons in crisis management—banks should be positioned to respond clearly and confidently. To a far greater degree today, bank reputations during crises are subject to rapid changes, due to digital media and an ability to rapidly move funds between institutions. In an industry underpinned by risk management, bank leadership teams need to reinforce accurate and positive stability perceptions of their banks before a crisis breaks out (e.g., financial stability is a hygiene factor in bank-selection criteria).

Don Raftery, Chris McDonnell and Cheri Derrick are the authors of this publication.