Table of Contents

We recently gathered input from 16 corporate-bond liquidity providers, examining their views on liquidity, where they see opportunities for innovation and the market’s next step forward. Their key areas of planned investment—direct connectivity to clients and ways to better leverage their client network—are another sign that the market has fundamentally changed from its post-credit-crisis norm.

But not everything has changed.

Working a Trade: Then and Now

“Working a trade” is the industry vernacular for how dealers and other liquidity providers help clients execute their orders. In highly electronic markets like equities, this most commonly entails selecting the right execution algorithm in which to enter the order.

In over-the-counter markets, however, finding the other side of a trade can be much more complicated. In the good old days—pre-2008— the dealer often accomplished this by simply buying the bond from the customer and putting it into their own portfolio (aka capital commitment, using the balance sheet and/or taking the bond into inventory). This gave (what turned out to be) the illusion of instant liquidity.

For the past decade, however, with balance sheet less available, working a trade more often entails the liquidity provider tapping their client network in hopes of finding someone that is interested in doing the opposite of what the order-placer is doing: a seller for the buyer or a buyer for the seller. If this sounds like finding a needle in a haystack, it essentially is. One could argue this is exactly what sell-side bond traders truly get paid to do.

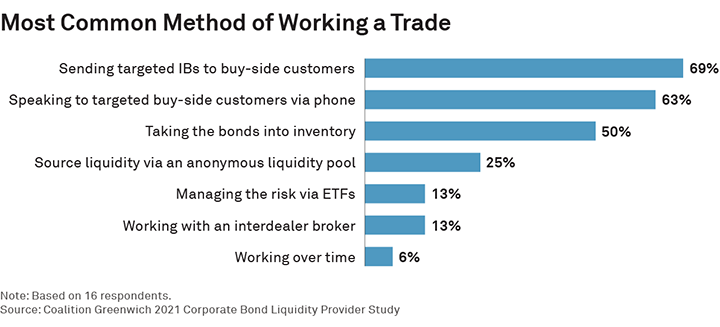

However, while the buy side continues to move a larger share of its trading onto the screen (accounting for 39% of investment-grade bond trading volume in August 2021), the dealer community still works most of its client trades the same way it did in 2007. Roughly two-thirds of bond dealers told us that their most common methods of working a trade are sending targeted chats and calling clients directly. And only half said they take the bonds into inventory—still a high percentage, but certainly less than it would have been 15 years ago.

Of the newer liquidity-sourcing tools available, using an anonymous liquidity pool is the most common method, at 25%. This reflects dealers’ growing adoption of MarketAxess’s OpenTrading and Tradeweb’s Dealer Sweep. On the other hand, managing risk via ETFs—a popular topic in fixed income—was cited by only 13% and is used mainly by the nonbank liquidity providers.

E-Trading Tools Bolster Dealer Relationships

These findings convinced us that there is still a significant opportunity for electronic trading tools to help the sell side work their client orders. There is also an equally large opportunity for the buy side to better leverage their dealer relationships.

It is important to note, however, that while traders are still chatting and calling clients directly, they are doing so exponentially better informed than their predecessors were in the ‘80s and ‘90s. A recent Greenwich Report explains:

“To be fair, what this question doesn’t capture is how those liquidity providers decide whom to call or IB, what prices to bid or offer, and when it makes sense to commit capital to a given client or trade. Data and analytics from the trading venues, data providers and liquidity providers themselves drive much smarter decisions and allow orders to be more smartly worked, even if they are worked through legacy channels.”

Nevertheless, the current process should be taken several steps further. Why not reinforce the current dealer workflow by taking the data that informs the trading desk today and use it to suggest trading opportunities to clients directly, creating a digital trading floor?

This idea has taken on a whole new meaning in today’s world. The dealer still owns their customer network but is now able to use it more efficiently. This change doesn’t need to replace the existing workflow that allows market participants to seek liquidity via a trading venue, but it could greatly enhance the dealer processes used to fill client orders submitted via RFQs or anonymous pools.

A More Multilateral Model

Thinking further ahead, markets could move toward a more multilateral model. While all-to-all trading pools allow every flavor of market participant to act as both a maker and taker of liquidity—regardless of their trading counterparty’s firm type—the resulting trade remains between just two counterparties (even when an agent sits in between).

The corporate bond market is only now evolving to allow multiple counterparties to help fill a single large order, which has long since been the case in U.S. equity markets. New entrant LTX’s offering is a good example of this.

A mechanism to allow this would do a few things. First and foremost, the order initiator could see price improvement with more than one contra-participant involved in the transaction. For example, think about a regional bank that can’t bid on the $5 million block but could offer the best price on $1 million. Combine that with similar bidders, and the seller could come out ahead by executing the full amount, potentially with price improvement due to increased demand. How this expected price improvement would stack up against other mechanisms, such as all-to-all and portfolio trading, remains to be seen.

Second, such a model could bring more liquidity providers to the table. Those able to offer quality prices but in smaller sizes could start to see higher hit rates and interactions with more customers, even if via a large dealer acting as agent. The corporate bond market has seen electronic liquidity jump in amount and quality over the past several years, as nonbank liquidity providers have entered the scene. We think this model could play a part in driving that further forward.

And third, this could help dealers rethink how they tap their client networks to unearth liquidity while simultaneously limiting their need to utilize scarce balance sheet. Systemically showing trading opportunities to other clients and then aggregating their offered liquidity back to the order initiator could ultimately create a better outcome for everyone, especially for larger orders that might be hard to execute on the screen today.

Getting There

This is all much easier said than done. The industry needs data scientists galore to automate the mind of the modern bond trader. And changing mindsets and tried-and-tested workflows can often be more difficult than the most complicated quantitative model. But ultimately, technology like this only makes people smarter and allows them to spend time on even more complex tasks they didn’t have time for in the past. A global pandemic didn’t end the trading floor, and neither will AI.