Table of Contents

With the initial shock of the COVID-19 pandemic behind us, corporates in Asia are gradually adapting to the “new normal.” For many businesses, the reality of the sustained impact on their operations, sales and supply chain is driving changes to forward-looking business plans and projections.

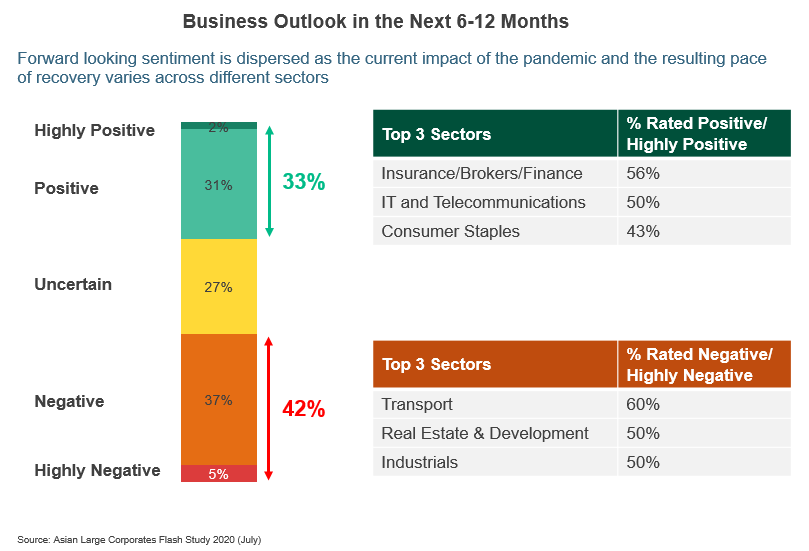

Business Outlook Varies by Industry

Unsurprisingly, up to 42% of the companies sharing their views with Greenwich Associates in a July flash study see the business outlook in the next 6–12 months as either “Negative” or “Highly Negative.” Importantly, however, one-third of the respondents are fairly optimistic about business prospects in the near term, while the remaining 26% of companies are “Uncertain.”

This range of business sentiment reflects industry differences in the extent of the pandemic’s current impact and the resulting shifts in business trends. As pandemic control measures such as social distancing and travel restrictions look to be in place for longer, sectors dependent on human contact, manual operations or frequent travel are undoubtedly going to be impacted much more extensively.

Businesses that are operating remotely or are facilitating the transition toward greater digitization will not only weather these disruptions but may see greater opportunities in the future.

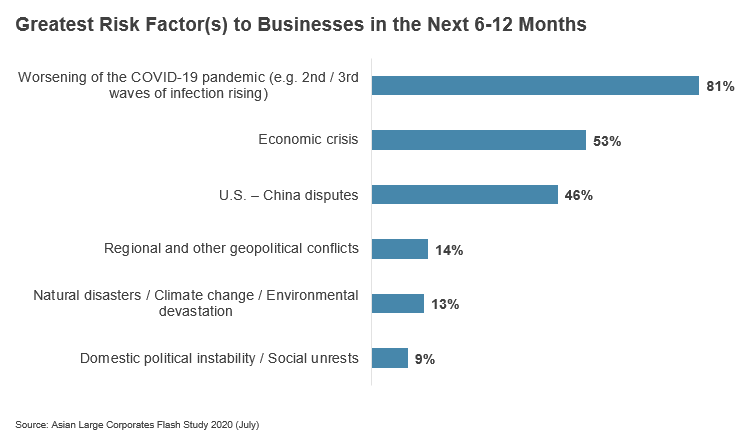

COVID-19 as a Macro Threat

Nonetheless, the challenges we are facing today are also continuously evolving. When we ask corporates to name the greatest macro risks in the next 6–12 months, they rank the worsening of the COVID-19 situation as No. 1.

With many economies reopening after initial lockdowns, the risk of further disruptions if various economic activities must be shut down again would be highly detrimental. As we race toward finding a vaccine for COVID-19, a large number of businesses are also concerned about the prolonged effects of the pandemic.

More than half of the respondents see economic crisis as a real risk in the coming year. Adding to that are the potential risks from the ongoing economic cold war between China and the U.S. (see our Q2 2020 Greenwich Report Gearing for a Seismic Shift in the Global Supply Chain).

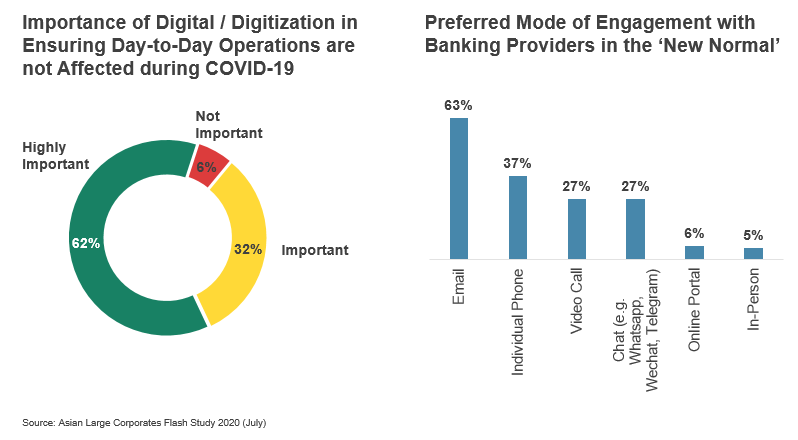

Digitization Ensuring Day-to-Day Operations

We discussed the surge in digital adoption in corporate banking earlier this year (in Social Distancing Boosts Digital in Corporate Banking) as a direct result of lockdowns imposed in many countries.

In our July flash study, we again took the pulse of how digitization is playing a major role in ensuring businesses continue to function in the new normal. Sixty-two percent of corporates in Asia say that digital solutions or digitization has been “highly important” in ensuring that day-to-day operations are not affected during the pandemic. Another 32% view it as “important.” This supports our view that corporate banking providers can give tremendous value to their clients when they help advise on and implement digital solutions for the relevant corporate and treasury functions.

Our upcoming trade insights will include details on banks rated as most supportive to clients during the pandemic and key areas of support provided.

Finally, as companies look to extend business continuity plans and work-from-home arrangements, the preferred medium for interaction has shifted as well. Since in-person meetings are highly limited, video calls and instant messaging (e.g., WhatsApp, WeChat) have emerged as important tools for business communication. Once information is exchanged over emails, corporate executives do appreciate banking providers checking in or following up with them using these tools.

Greenwich Associates welcomes the opportunity to share additional information about how expectations and perceptions are changing in corporate banking during this crisis.