One and a half years from the initial outbreak of COVID-19, the healthcare, economic and business conditions across most Asian markets remain vulnerable and highly fluid. Nonetheless, business sentiments have largely stabilized compared to the shock many corporates faced in the first half of 2020.

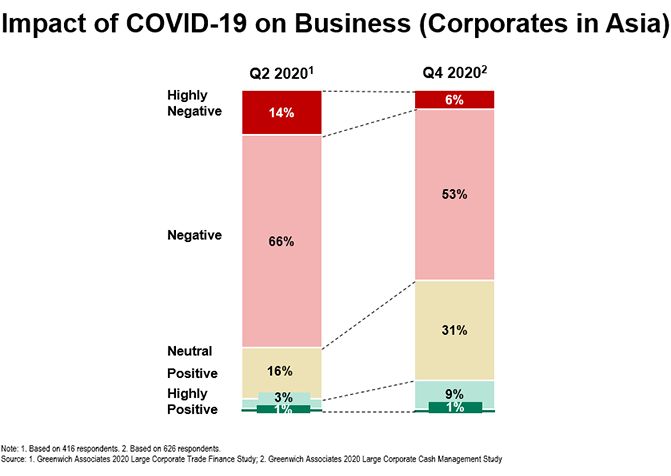

While 80% of corporates in Asia saw their business impact as ‘negative’ to ‘highly negative’ in the second quarter of 2020, this number has moderated considerably to 59% by the end of the year. Corporate priorities have also shifted significantly during this period, as businesses adapted to the new realities together with their key stakeholders.

Banks Highly Supportive during Crisis

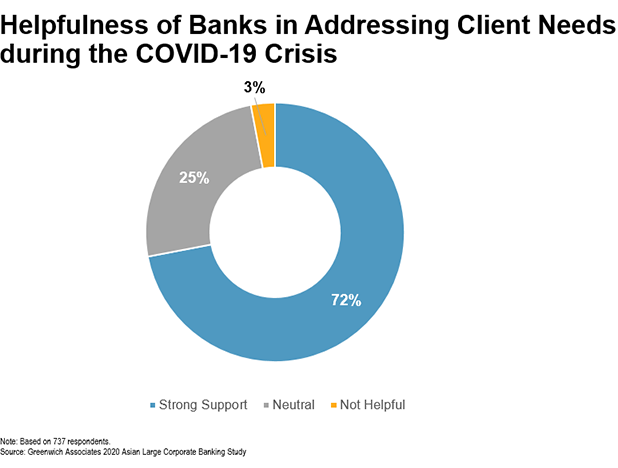

During the second half of 2020, Coalition Greenwich spoke with 840 large corporate key decision-makers in Asia about the main challenges they faced during the COVID-19 crisis, and how their banking partners have played an important role in helping them navigate this difficult period.

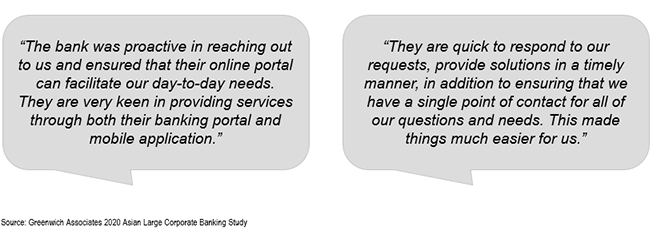

Notably, over 72% of the corporates interviewed say their banking partners have been highly supportive of clients throughout the past 12 months—a similar trend to what we have observed in Europe and the U.S. corporates have cited not only the extensive liquidity support by their key banking partners, but also the operational agility and proactive initiatives taken by banks to aid clients in adopting digital processes to sustain day-to-day operations.

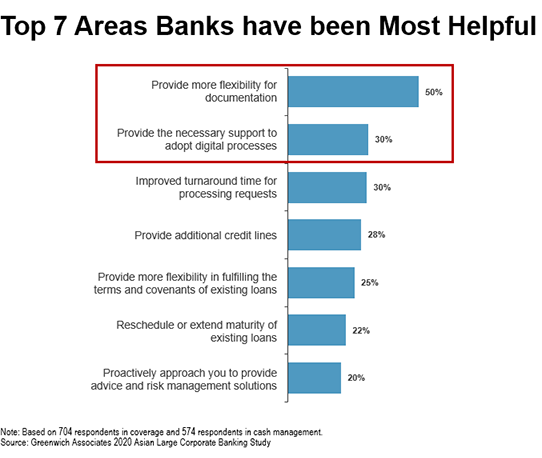

Largely, banks have performed favorably in meeting the expectations of corporate clients. When recounting what they most appreciated from their banking partners, corporates cite the flexibility banks provided in documentation—for example, by accepting e-signatures and providing easy access to online tools—all while maintaining a high level of security and compliance during periods of lockdowns and mandatory work-from-home arrangements.

Digital Banking Solutions are Key

As the level of digitization varies greatly across different corporates, banks that stand out the most during this crisis, are the ones that can provide the necessary support and advice to help clients develop and/or adopt relevant digital solutions to cope with day-to-day treasury and business functions. As such, COVID-19 has presented a unique window of opportunity for banks to drive implementation of digital banking solutions and greater integration of corporate and banking processes, e.g., via APIs. (This topic will be further covered in an upcoming Greenwich Report on “Future Operating Models.”)

Standout Banks in Asia

Among the most prominent banks in Asia, seven emerged as the standout banks that have been the most supportive to clients in mitigating the impact of COVID-19 on their business:

These banks have demonstrated a high level of awareness to client needs and the operational agility to respond to client requests and needs in a timely manner during this challenging period.

Looking Ahead

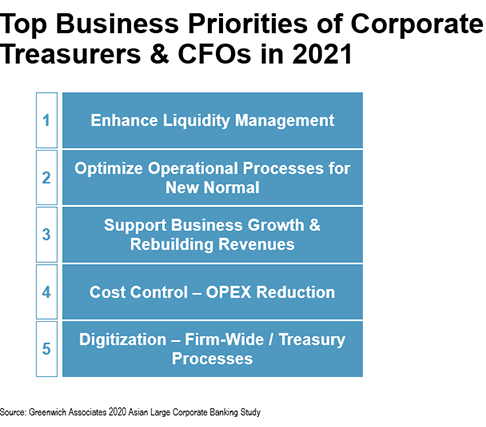

Moving forward, aside from the basic corporate treasury goals of enhancing liquidity management, corporates in Asia are primarily focused on reviewing existing functions and setting up more optimized operational processes for the ‘new normal’ and the digitization of firm-wide treasury processes (see ‘Top Business Priorities’ below).

Now, more than ever, corporate treasurers and executives are open to partnerships and solutions that can help them achieve these goals. Banks are in a unique position to advice and lead these conversations. Those that do are more likely to form deeper relationships that will last beyond this pandemic.