Triggered by the COVID-19 pandemic, relationships between banks and corporate treasury functions were once again pushed to the limit. Coalition Greenwich recently gathered feedback from over 450 large corporate decision-makers across western Europe, who shared how well they felt supported by their corporate banking partners, along with the type of action they considered to be particularly helpful. As a result of these in-depth conversations, we identified those providers who stood out in mitigating the impacts of COVID-19 for their clients.

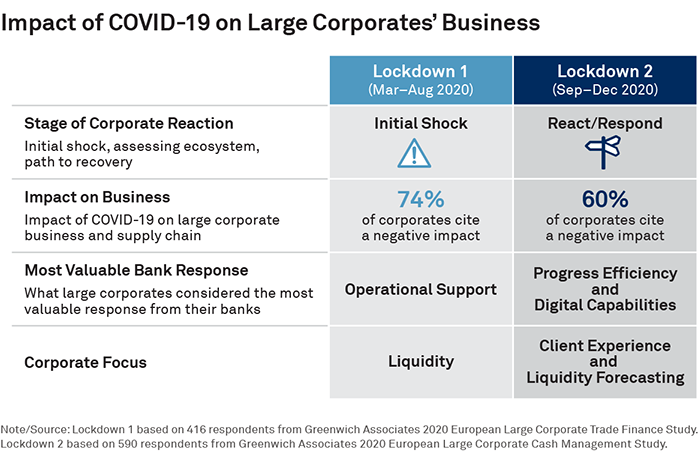

The COVID-19 crisis created significant challenges for the majority of large corporates across Europe. Among those participating in our Large Corporate Banking Study during the second half of 2020, 60% reported being negatively impacted by COVID-19. This is an improvement from the 74% that felt negatively affected in the first half of the year, however, and we thus expect further progress leading into the summer of 2021.

Weathering the Storm Together

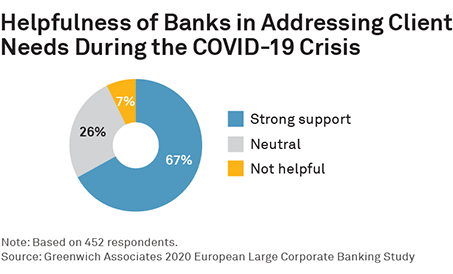

Reflecting in this context on bank-firm relationships, best news first: Different from the financial crisis in 2008/09, two-thirds of European large corporates interviewed have experienced strong support from their banks since the COVID-19 crisis began in March 2020. Corporates have been sharing that there is “a strong feeling that we all belong to the same ecosystem and, as such, have to support each other to weather this unprecedented storm,” as a group treasurer of a large German manufacturing company expressed.

Understanding the Evolving Needs as the Crisis Progresses

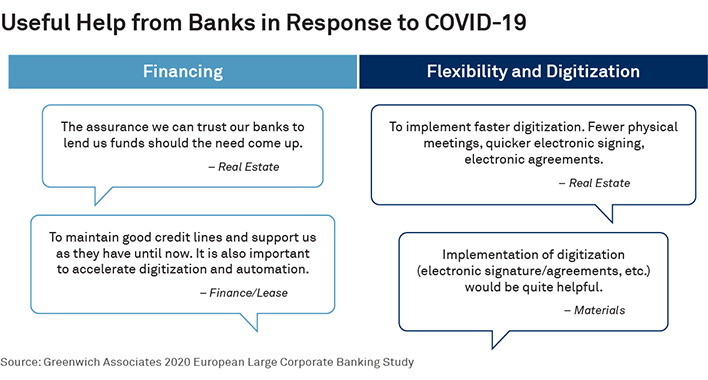

When trying to understand the key actions taken by banks that corporates found particularly helpful, our data-driven insights clearly identified measures that have evolved as the crisis progresses. The type of support considered particularly helpful hinges on which stage of the COVID-19 crisis a corporate is in. To be effective in their support throughout the crisis, understanding this evolution was crucial for the banks to be able to offer the right support at the right moment.

In the beginning of the crisis, the majority of corporates that needed help from their banks were in an initial shock phase and thus were focusing on securing liquidity and valued basic operational support, such as the quick deployment of e-signatures. Only when corporates reached the second phase, in which they started to move from “reacting” to “responding” to the challenge, did the emphasis shift to process efficiencies and, with it, improved digital capabilities—all of which had a strong impact on client experience. Liquidity remains important in this phase.

However, it became clear by mid-2020 that we were not in a liquidity crisis, and the emphasis shifted from simply securing liquidity in the first place to managing liquidity more effectively. The majority of corporates reached that phase during the second lockdown, and expectations of what is considered helpful evolved with it.

And the Winner Is…

A range of regional as well as global banks were helpful at different stages of the crisis. However, when having to vote which banks have been standing out as most supportive in mitigating the impacts of COVID-19 on their business, senior corporate treasury professionals across Europe have recognized the following eight partners:

These banks maintained a strong, coordinated and continuous flow of information between their corporate clients and the different departments of the bank, enabling them to address the evolving needs of the client at the right time. They were able to accommodate liquidity needs and allow an increasing amount of operational flexibility while managing the potential risks associated with it.

Going forward, as an increasing number of corporates will enter onto their path of recovery, we expect these corporates to shift their emphasis yet again. With a significant number of corporates then being ready to rebuild and reinvent themselves, they will look for their banks’ advisory capabilities to get the right support in making strategic decisions for the future.