What started as panic selling from the Fed’s extreme tightening in Q1 2022 turned into excited buying by retail investors in Q4, with tax-loss harvesting and tax-free (and low-risk) yields nearing 5% offering what many saw as the chance of a lifetime.

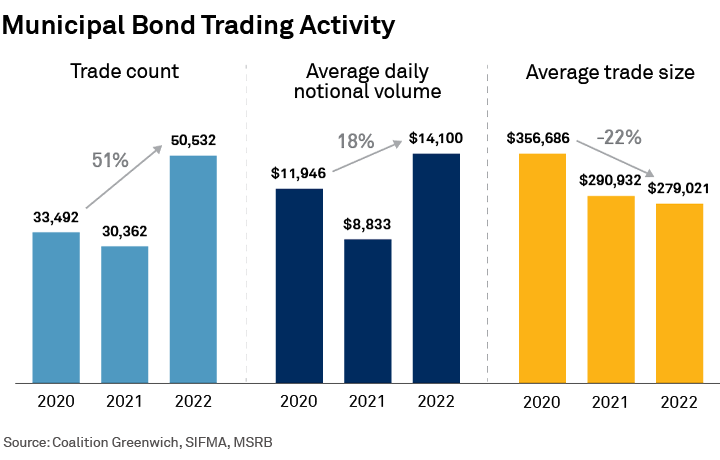

The coming months will tell us if Q4 2022 was, in fact, a good time to buy. Regardless, municipal bond trading in 2022 was a sight to behold. The average daily trade count in 2022 jumped to over 50,000—an amazing 51% increase from 2020. On a notional basis, trading volume was 18% higher in 2022 than in 2020, and a more impressive 60% higher year over year. This uneven growth in trade count and notional volume traded led to a decline in average trade size, down 22% from 2022, which equates to $279,000 per trade.

Electronic Trading Was Flat in 2022

The activity in munis largely reflects a similar trend we observed in U.S. corporate bonds, where the average daily trade count soared and average trade sizes declined. But unlike the corporate bond market that saw e-trading surge in 2022, muni bond electronic trading as a percentage of the total has changed little. Coalition Greenwich estimates show that 14% of muni bond volume traded electronically in Q4 2022, up 3 percentage points from Q2.

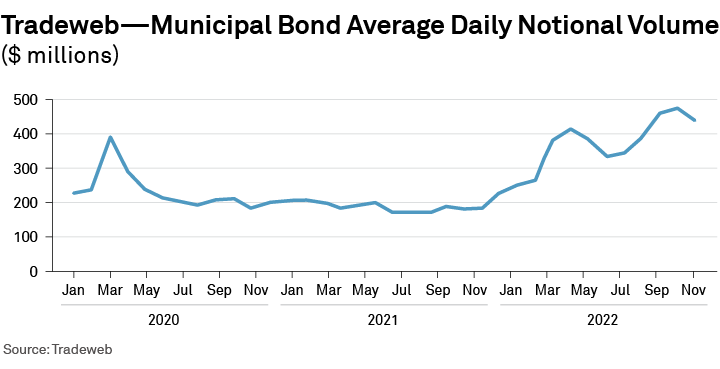

On the positive side, this result shows that e-trading kept up with, and in some cases surpassed, the market’s volume surge. Tradeweb, who we can use as a proxy for the muni e-market, saw their volumes jump 56% from 2020 to 2022, and an impressive 93% year-over-year. Nevertheless, the market overall continues to buck the electronic trading trend that has for the last decade taken over government and corporate bond markets.

Looking Ahead: Muni Market Electronification

Despite the slow progress, we remain convinced that more of the municipal bond market will trade electronically in the years ahead. The most tech-forward asset managers have already moved toward a world in which the majority of their trading is done on the screen. Further, automated market-making has existed in munis for years, and still presents spread-capture opportunities that are already drawing in new entrants. More liquid muni ETFs will only help that trend, just as credit ETFs did for corporate bonds.

It’s also important to remember that market electronification isn’t just about traditional electronic trading, but also increased automation of the trading and investing life cycle. Even if the final terms of a trade continue to be negotiated via chat or the phone, there is nothing keeping the pre- and post-trade workflows away from automation.

One million CUSIPs and very regional demand for municipal bonds certainly complicate the move to the screen. But the last decade is littered with electronic trading growth and innovation that was once thought to be impossible. The next decade will be the same.