There has been plenty of talk amongst the industry about the MiFID II rules aimed at bringing more transparency to dark pool trading venues across Europe. Regulators claim the lack of transparency and details around transactions is dangerous for market participants, especially retail investors. Retail investor protections are important to market stability but regulators appear to be forgetting that institutional investors are more than just HFT and speculative investors. In fact, institutional investors are actually the ones investing retail money. As many had suspected, market participants continue to shrug-off the warnings and worries of regulators in favor of executing where the liquidity is – which is in the dark.

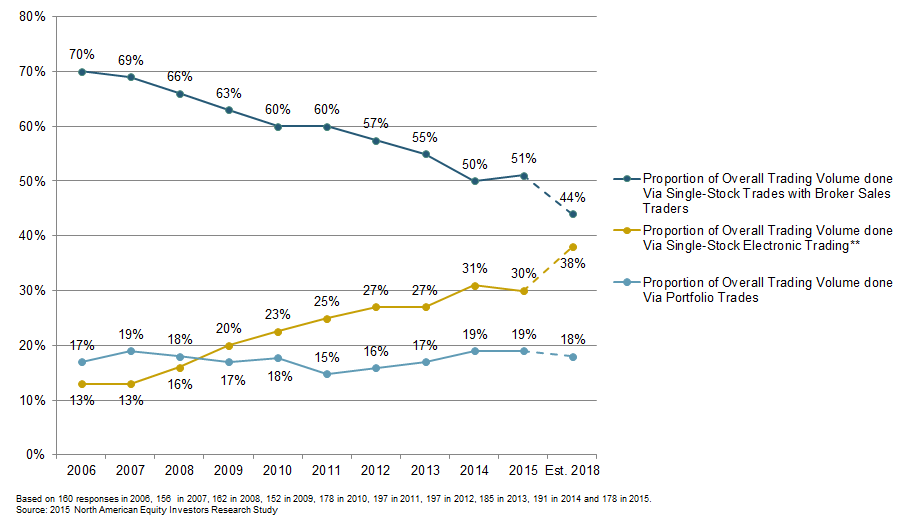

A recent article by John Detrixhe at Bloomberg noted that trading on dark pools increased 45% across Europe during 2015 despite the constant looming pressure from new regulatory mandates on dark pool trading activity set to take effect by 2018. In times of constrained markets, investors will always look for the liquidity. In a recent report, our research found that buy-side investors have been steadily increasing their volume through electronic channels in general as capital and services offered by the sell-side become harder and harder to access. Electronic channels, including dark pool venues offer quick and cost-effective access to the market.

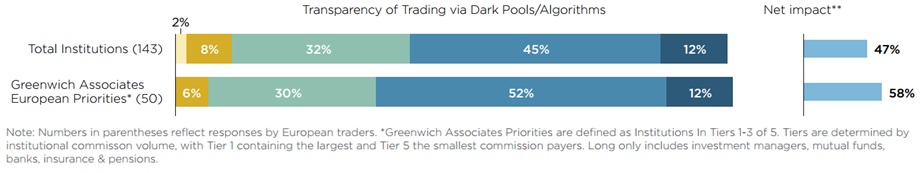

Despite what regulators assume, buy-side investors believe in the role dark pool trading venues play in the market place. Buy-side investors believe in the principals behind regulators arguments as noted in the recent Greenwich paper “European Equity Trading and the Consequences of Regulation” but the increased use of dark pools in 2015 indicates market participants do not believe in the practical application expected in the new rules.

With other regulations impacting sell-side balance sheets and services offered to the buy-side, we expect to see continued growth in the use of dark pool trading venues leading up to the full implementation of the MiFID II rules and beyond. Until liquidity leaves dark pool trading venues, the buy-side, sell-side and regulators will need to operate in the dark.