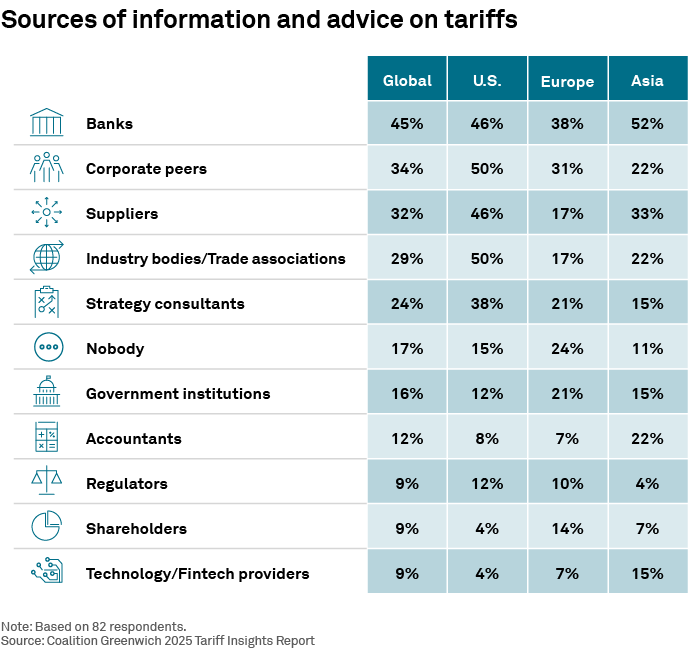

One pervasive problem for companies in 2025 has been difficulty obtaining reliable information about tariffs, and insights about how to best navigate a constantly shifting set of trade policies. Throughout this period, banks have proven to be a value source of advice to corporate leadership teams around the world.

Approximately 45% of large companies say they have turned to banks for strategic advice and/or implementation assistance with rapidly evolving tariff announcements. More than half of Asian companies and approximately 60% of consumer-facing companies say they are relying on banks for information and guidance on changes in global trade policy. At a global level, that puts banks at the top of the list, ahead of corporate peers (34%) and suppliers (32%), industry bodies and trade associations (29%), and strategy consultants (24%).

Going forward, banks have an opportunity to deepen client relationships and potentially create opportunities to expand relationships across banking, cash management and trade finance by proactively reaching out to companies with accurate and up-to-date information on fast-changing trade policy, and insights and ideas on how companies can navigate this new environment.