Table of Contents

One of the most interesting questions we ask our participants in the annual Market Structure and Trading Technology study is which technologies have the most potential to be truly impactful on the trading desk. In other words, where does the hype (or lack thereof) match the reality?

We have long tracked existing and emerging trading technologies and there have always been both over-exaggerated and under-hyped technologies. However, the trading desk has always been willing to embrace what actually works—benefiting performance, liquidity, speed, price, and client service—as well as what supports new investment ideas (front office) and automation of workflows (middle and back office).

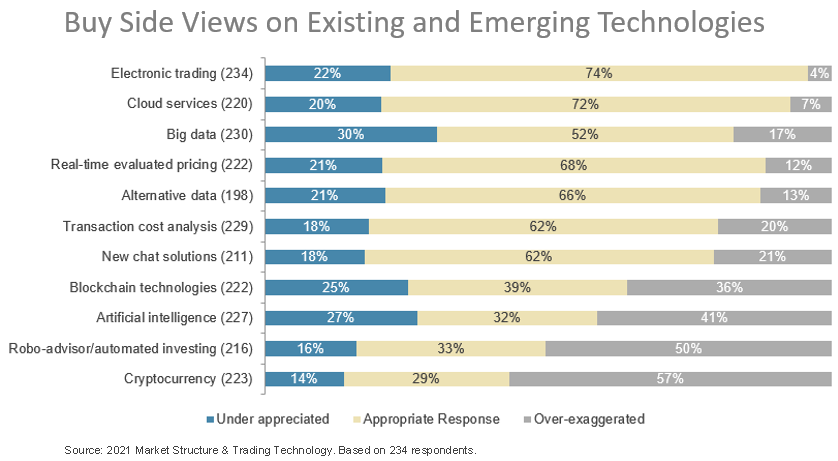

To bring clarity to current views, we recently asked 234 equity and fixed-income investors across Europe and North America to rate different technologies according to the following: Which have been over-exaggerated, which have had the appropriate response, and which are underappreciated (under-hyped). While some of the results may seem obvious, others point to a shorter-term view that could leave some missing the potential benefits of emerging technologies going forward.

Underappreciated Technologies

Based on the study, there are clearly some technologies that traders believe are over-exaggerated or that divide opinion. However, there are also areas where there is perhaps not enough attention or appreciation. Here are our findings:

Electronic Trading: There is a strong consensus that electronic trading is either appropriately rated (74%) or underappreciated (22%) across North America and EMEA. This is unsurprisingly bullish on the impact of electronic trading over the long term across equities and fixed income globally.

Fixed-income traders are more likely to say electronic trading is underappreciated. And, of course, electronic trading is well established in the equities market, so it is reasonable that fewer respondents in that space would think of this technology as being underappreciated. Despite the growth of automation in fixed-income markets in recent years, manual processes still exist and, in some parts of the market, are still the norm. So while traders have enjoyed the benefits of technology innovation in the market over the past few years, most feel opportunity for improvement still exists.

Big Data: It is clear that traders across asset classes are bullish on the impact of data. In fact, big data is the segment that respondents rate as most underappreciated (30%). Data and analytics have clear potential, and while not every trader can make use of big data for trade ideas or trade executions, it’s clear that traders see that opportunity exists.

Again, fixed-income traders as a group are even more bullish on big data and alt data than equities. The amount of data available to fixed income traders has ballooned in the past decade, and we are in a phase in which market participants are working hard to put that data to work.

Cloud: Cloud computing came in as appropriately rated (72%) or underappreciated (20%), demonstrating its real world impact. Like electronic trading, cloud appears to be recognized by traders as having a lot more runway to impact the industry despite its strong growth in recent years.

We will be conducting in-depth cloud research in the coming months, probing on the importance of cloud for both trading infrastructure as well as market data. We will also examine why traders and infrastructure providers might still see cloud computing as underappreciated.

Emerging Technologies

Crypto: Traders still need a lot of convincing on cryptocurrencies. And equity traders are even more skeptical, about half as likely as fixed income traders to find crypto underappreciated. 57% of respondents believe that the impact is over-exaggerated. This is to be expected as most traders think very little about crypto day to day, have no mandate to trade it, and don’t see crypto displacing equities or fixed income anytime soon. Of course, if we asked just crypto hedge funds and some crypto-focused institutional managers, those numbers would be very different as crypto has an enthusiastic supporter base.

AI: Interestingly, AI has really divided traders. Next to crypto, AI is the second segment to be rated least as having an appropriate response. And while 41% say AI is over-exaggerated, it does have its adherents too at 27%.

DLT: Blockchain has divided traders as well, with strong opinions on each side, although a little more balanced than AI. However, 36% think it’s over-exaggerated.

Robo advisors: Half of traders think robo-advisory has been over-exaggerated. Traders appear to think that automated investing won’t have as much impact as many believe (or that much of the impact has already been built into the current system).

Summary

Overall, the gains in technology and automation in equities over the last decade seem to indicate that there’s room for fixed income to adopt more trading technology and automation as well. For instance, there is certainly a need for more fundamental data, reference data and evaluated pricing data in fixed income. There also appears to be a lot more runway for cloud to impact the industry globally and across asset classes.

It will be fascinating to see how traders continue to look at these technologies and their actual impact versus the perception of the overall marketplace.