Greenwich Associates research shows that companies are being attracted by nonbanks’ ability to deliver credit along with a high quality customer experience. This includes a rapid turnaround on loan applications.

While there have been negative headlines for several of these nonbank lenders over the past month or so, and their focus is often on less credit-worthy borrowers outside of the traditional underwriting criteria for banks, they are earning the business from a segment that shows meaningful loyalty.

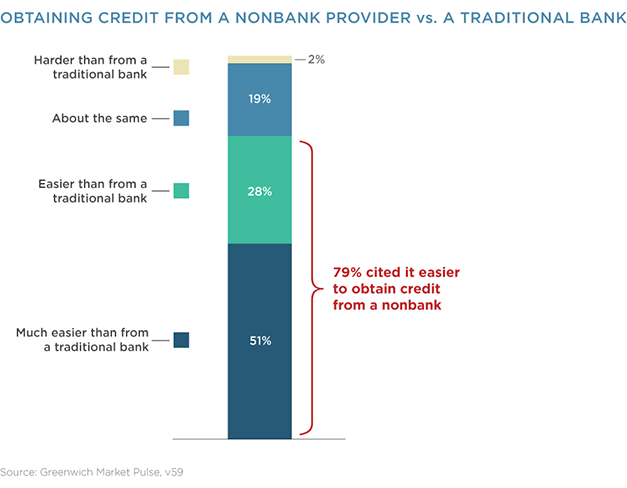

About 8 in 10 companies that have borrowed from nonbank lenders say the process of obtaining credit is easier with nonbanks than with traditional banks. A full 51% of those nonbank borrowers say it is actually “much easier” and 94% indicated that they would obtain credit from a nonbank provider again.

Bottom Line

Business executives are becoming less loyal to their relationship banks and more willing to consider rivals, including nonbanks and fintech providers offering better pricing, advice or a technology-enhanced customer experience.

Nonbanks often leverage technology platforms and advanced algorithms to provide a fast, seamless customer experience, which makes traditional bank offerings seem stale and cumbersome.

This divide in technology prowess will play a major role in shaping the industry over the next five years.

Download The Future of Banking: 2025 to learn more