Table of Contents

Indian companies are increasingly moving away from the traditional practice of concentrating most of their banking business with their biggest lenders. Instead, they’re seeking out and rewarding banks with the best product/platform capabilities. The trend, which was always prevalent in the investment banking space, is now becoming evident in the transaction banking and treasury space.

This “de-coupling” of fee-based business from credit represents an important turning point for an industry in the midst of a tumultuous period. Public sector (PSU) banks still control the majority share of assets in the Indian corporate banking space. As such, PSU banks have benefited from the fact that, until recently, companies in India generally considered their biggest lenders their primary banks, using them for the bulk of their fee-based business. However, those dynamics are shifting quickly.

Indian Companies Seeking Top-Quality Providers

India’s private banks have invested a substantial amount of capital to create state-of-the art platforms, including attractive new digital capabilities in domestic and international cash management, FX, trade finance, and other essential corporate banking functions. These investments are starting to pay off. As large companies discover the quality of these platforms, the number of “single-product” relationships in which companies use a bank for only a single, non-credit-related product mandate is growing rapidly. For example, an Indian company with limited/no borrowing relationship with HDFC might still use the bank for domestic cash management simply to access the bank’s market leading cash management platform. At the same time, the share of banks naming their biggest lender as their primary banking relationship has dipped below 50%.

Indian companies that rely on their biggest lenders for critical services like cash management and FX without investigating the offerings of other competitors might find themselves at a disadvantage.

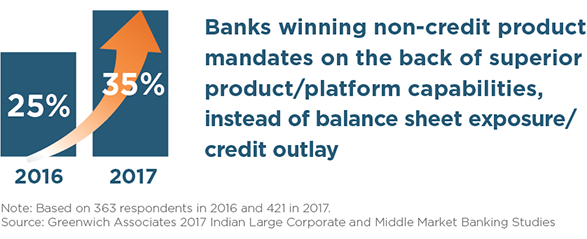

The graphic below shows the share of companies using “non-credit providers” for these products jumped from 25% in 2016 to 35% in 2017. Meanwhile, the share of companies awarding this business to one of their top credit providers dropped from nearly three-quarters to roughly two-thirds.

Over the past 12–24 months, PSU banks (and a few privately owned banks) have been at the center of an effort by regulators to prod banks into recognizing and digesting non-performing loans (NPLs) that threatened to undermine bank balance sheets.

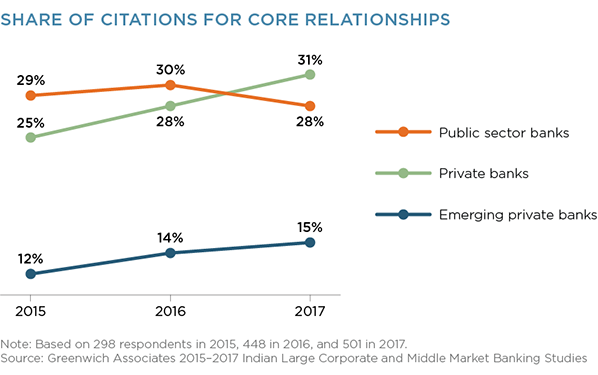

These actions, along with the changing dynamics around balance sheet losing its importance as an underpinning to the relationship are contributing to the rise of the country’s privately owned banks, which in 2017 surpassed PSU banks in their share of “core” banking relationships with large Indian companies.

The following graphic illustrates the gains India’s private banks are making at the expense of PSU banks. As the chart shows, India’s three largest private banks, HDFC, ICICI Bank and Axis, together are now ahead of PSU banks in terms of share of “core banking relationships” with Indian corporates. Meanwhile, “emerging” private sector banks like IndusInd, Kotak and Yes are steadily growing their own footprints.

Greenwich Leaders

This entire process is playing out in a period of flux. In addition to the NPL issue, the Indian banking industry has been rocked by scandals, such as buyers’ credit-related mishaps. These developments have contributed to a reduction in U.S. dollar liquidity for Indian corporates and an increase in short-term USD pricing that will cost companies more while providing a much-needed opportunity for banks to expand margins. Looking ahead, new rules and a clear framework for corporate insolvency proceedings should help improve loan recovery rates for banks, providing a financial boost for the industry while also potentially expanding the pool of liquidity available to lower-rated Indian companies.

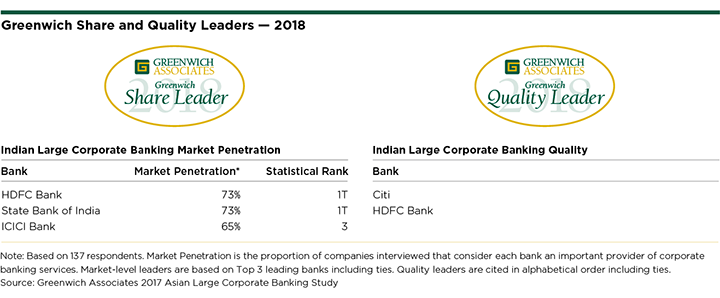

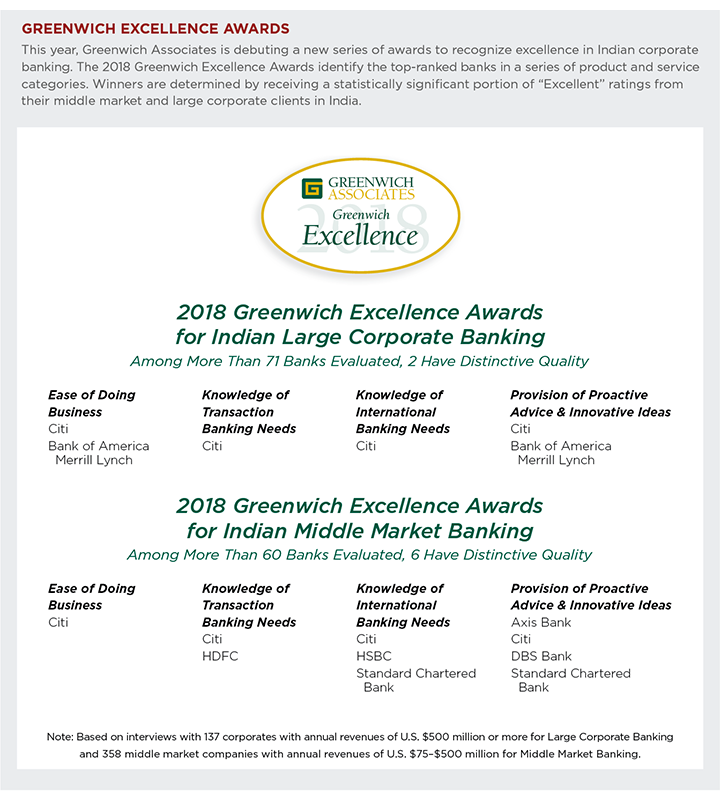

Amid these profound changes, HDFC Bank and State Bank of India (SBI) share the top spot as 2018 Greenwich Share Leaders℠ in Indian Large Corporate Banking, with estimated market penetration scores of 73%, followed by ICICI Bank at No. 3 with a score of 65%. The 2018 Greenwich Quality Leaders℠ in Indian Large Corporate Banking are Citi and HDFC. (Read the full report: Banks and Corporates Realign Relationship in Asia.)

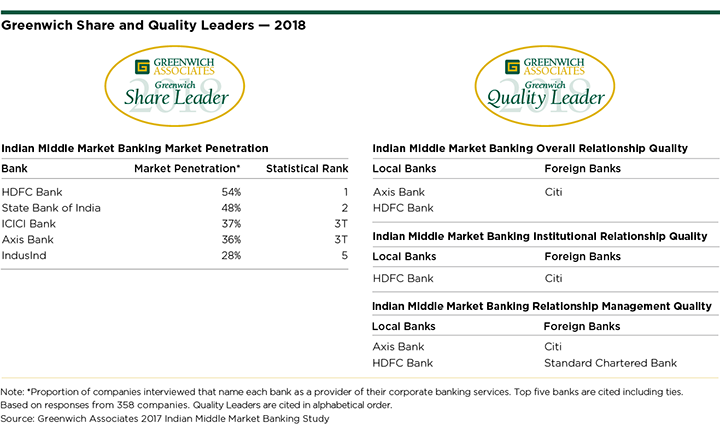

HDFC Bank has secured its position as the top bank on the list of 2018 Greenwich Share Leaders in Indian Middle Market Banking, with an estimated market penetration score of 54%. SBI is next with a market penetration of 48%, followed by ICICI Bank and Axis Bank, which are statistically tied at 36%–37%, and IndusInd at 28%. The 2018 Greenwich Quality Leaders in Indian Middle Market Banking Overall Relationship are Axis Bank, Citi and HDFC.

Balance Sheet Reforms Could Revitalize Public Banks

Look for India’s large PSU banks, starting with SBI, to make a reinvigorated and aggressive push in increasing their fee-based business in the not-too-distant future. Regulators’ efforts to encourage PSU banks to deal with the NPL issue will have two important consequences. First, it will force the banks to clean up their balance sheets, making them more financially secure and competitive. Second, tightening up lending standards will force PSU banks to lean more heavily on other fee-based businesses for revenue.

These dynamics will prompt PSU banks, at least the large ones, to build out and improve their own platforms in product areas such as transaction banking, treasury and others. As they do so, they will start to emphasize the “cross-sell” of these products to corporate borrowers. If Indian companies see PSU banks’ capabilities in these areas as sufficient to meet their needs, some will recognize the benefits of rewarding their biggest lenders with this additional wallet.

Greenwich Associates Head of Asia, Gaurav Arora, specializes in Asian corporate/transaction banking and treasury services.

For more information: ContactUsAsia@greenwich.com or call +65.6236.0142

MethodologyFrom September 2017 to January 2018, Greenwich Associates conducted interviews with 358 Indian middle market businesses and asked them to name the banks they use for a variety of services, including corporate lending, cash management, trade services and finance, foreign exchange, structured finance, interest-rate derivatives, and investment banking. Study participants were then asked to rate their banks in 14 product and service categories. From September to November of 2017, Greenwich Associates conducted 137 interviews in large corporate banking with companies in India. Subjects covered included product demand, quality of coverage, and capabilities in specific product areas.