A series of changes in institutional markets have intensified the competition for investment assets while ratcheting up expectations among prospects and clients. In the current post-crisis...

Asset managers have had another strong year in 2014.

Market appreciation and positive inflows boosted AUM for traditional firms, while hedge fund AUM continued to grow despite mixed results....

While mandatory trading of swaps on registered platforms kicked off in February, lack of reporting standards still makes using the data to drive business decisions difficult if not impossible. And...

Foreign exchange trading is seeing market share concentration shift evermore in favor of the top 5 dealers, as FX trading volumes remain sluggish due in part to lack of volatility in the global...

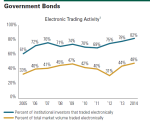

Although ideally suited to electronic trading, the U.S. Treasury market saw a significant drop in e-trading volumes following the financial crisis.

Electronic trading in government bonds now...

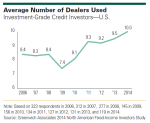

While the U.S. corporate bond market continues to be dominated by the top dealers, Greenwich Associates data suggests that institutional investors are beginning to explore new liquidity providers in...

The increasing use of exchange-traded funds in fixed income is contributing to the uptake of ETFs by Canadian institutions as a standard tool for achieving strategic goals in their investment...

Greenwich Associates research shows that in 2014 the percentage of clients rewarding dealers for fixed-income research jumped by roughly 100% to more than half.

Fed by an onslaught of market...

Complex regulations in both interest-rate derivatives and U.S. Treasuries are constraining profits for brokers and creating new buy-side demands.

The top five’s share of both product sets...

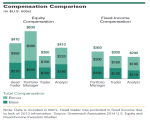

The growing importance of branding is reflective of the rapid evolution of the asset management industry in the post-crisis era. In the institutional market, investors’desire for advice and...