While the U.S. corporate bond market continues to be dominated by the top dealers, Greenwich Associates data suggests that institutional investors are beginning to explore new liquidity providers in...

The increasing use of exchange-traded funds in fixed income is contributing to the uptake of ETFs by Canadian institutions as a standard tool for achieving strategic goals in their investment...

Greenwich Associates research shows that in 2014 the percentage of clients rewarding dealers for fixed-income research jumped by roughly 100% to more than half.

Fed by an onslaught of market...

Complex regulations in both interest-rate derivatives and U.S. Treasuries are constraining profits for brokers and creating new buy-side demands.

The top five’s share of both product sets...

The growing importance of branding is reflective of the rapid evolution of the asset management industry in the post-crisis era. In the institutional market, investors’desire for advice and...

U.K. institutional investors are taking advantage of a lack of bank lending in property by pouring capital into real estate debt. While most institutions stick to the safest real estate debt...

In a large, sophisticated sector such as institutional financial services, business allocation decisions are driven by a complex combination of quality factors. A broad measure like overall...

Understanding how new regulations impact all derivatives and securitized products, not just swaps, and how cleared and bilateral markets interact in the new world is crucial for investors.

The...

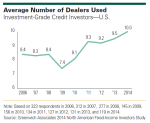

For the first time since 2009, buy-side institutions have reduced the number of firms they use for research and advisory services, and narrowed the number of execution partners as well. Despite this...

Investment consultants in the United Kingdom report a pickup in manager searches in real estate through Q3 2013, as institutional investors turn to property as a source of badly needed yield. However...