First, liquidity, as always, remains a top priority (at least in determining where orders are routed). When decisions are made on where and how to direct orders, a driving focus will always be the likelihood of execution.

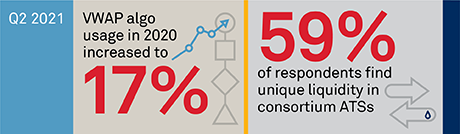

Second, the manner in which you access liquidity is also exceedingly important. Understanding where you can find unique orders can help you be more successful in executing better volume.

Third, those seeking larger orders will continue to push for innovation around the use of conditionals or other block-size functionality (or for other market structure enhancements), to help them reach their ultimate goal of executing their intention without giving away their hand.

The successful triumvirate is the informed buy-side trader who understands what trade they want to execute, the experienced sell-side trader who can navigate the marketplace to help find the best solution for the particular moment in time, and the venues that deliver differentiated liquidity—whether by order type or by counterparty, or both.

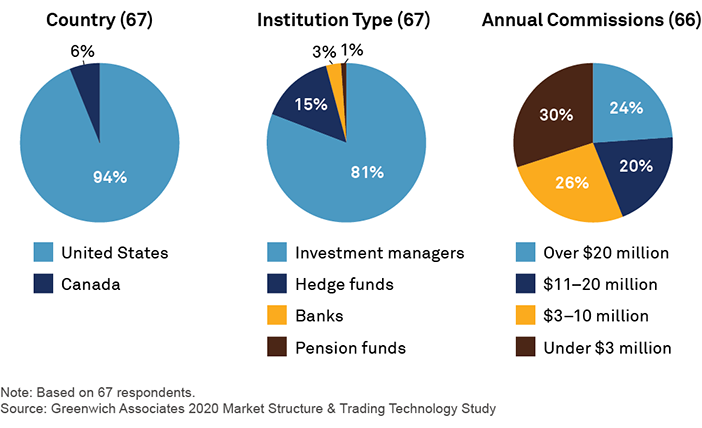

MethodologyBetween August and October 2020, Greenwich Associates interviewed 67 North America-based buy-side equity traders. Respondents were asked a series of qualitative and quantitative questions about various market structure topics, including their use of algos, perceptions of liquidity across venue types, and routing behaviors. In addition, Greenwich Associates analyzed FINRA ATS Transparency Data over the same time period in order to understand execution across the U.S. market.