Alternative data is getting closer to the tipping point. Almost half of buy-side professionals in our recent study describe themselves as medium-frequency users, with a significant proportion having utilized these datasets for two years or more. Moreover, alt data continues to be used in portfolio construction, a testament to its potential to drive alpha. As a result, spending on alt data is poised to surge, with 63% of investors planning to increase their outlays, driven in part by the transformative power of generative artificial intelligence (GenAI).

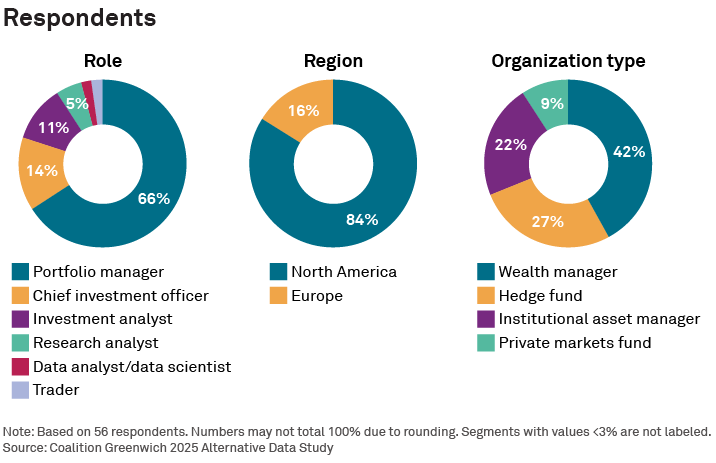

MethodologyThis study is an update to our series of studies designed to better understand the trends and challenges of alternative data use by the buy side in the United States, United Kingdom and Europe. Between September and October 2025, Crisil Coalition Greenwich gathered responses from 56 buy-side firms, including wealth managers, hedge funds, institutional asset managers, and private markets funds. The majority of insights stem from roles including portfolio manager, chief investment officer, investment analyst, and research analyst. The study also covers a range of investment strategies across equities predominantly, with some fixed income, reflecting a combination of fundamental equity, quantamental, quantitative, and fixed-income strategies.