In its early days, alt data for investment and trading decisions was procured separately from traditional market data. Today, traditional financial information vendors and aggregators have expanded into this market and are developing offerings and marketplaces intended to make discovery, acquisition and ingestion easier than ever. Some are doing the heavy lifting to make alt data more consumable through data normalization, embedded tags to tradeable securities, and by offering APIs, for example.

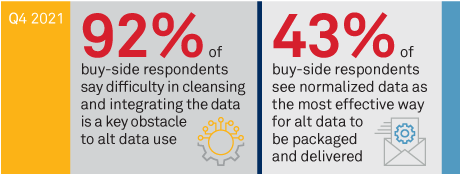

However, alt data creates challenges as well as an edge, and the investment management industry needs modern tools, techniques and data expertise to support alt data’s expansion into the investment process. This report focuses on how alt data vendors and aggregators can assist the buy side by removing obstacles, offering enhanced services and providing leading-edge expertise.

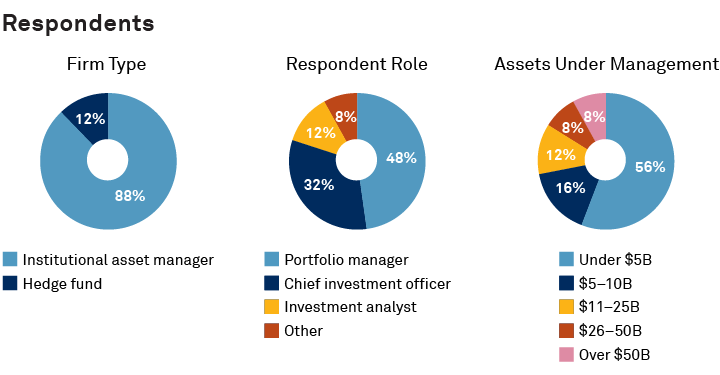

MethodologyBetween May and July 2021, we interviewed 25 executives at asset managers and hedge funds in North America to better understand the usage of alt data, spending trends, types of datasets used, and pain points in adoption. Respondents primarily comprised asset managers and included a mix of investment styles.

We spoke with investment professionals, including portfolio managers, chief investment officers, investment analysts, and others.