From equities to fixed income, the number of financial products available to portfolio managers is impressive. While the financial crisis all but dried up the market for complex structured products, the following 10 years brought a host of new, more straightforward instruments that have, in some cases, enhanced liquidity and eased access to the underlying markets. Many of these benefits continue to go underutilized, however, as the analysis to determine the most effective instrument choice for the given situation is non-trivial.

Portfolio managers and their trading desks primarily choose instruments based on past experience rather than through an analytical process. While the accumulated knowledge of an experienced portfolio manager should not be undervalued, a move toward more systematic instrument selection would ultimately enhance fund returns by capturing alpha invisible to the naked eye. Should you buy a bond or use an exchangetraded fund (ETF) or credit default swap (CDS) to gain that exposure instead? Now more than ever, analyzing that not-so-simple question on demand throughout the day could have an outsized impact not only on the portfolio but on the market as a whole.

For instance, 90% of U.S.-based corporate bond investors1 say that a lack of liquidity has impacted their ability to implement their investment strategy, and volatility in the roll process is adding additional costs to derivatives-heavy portfolios. At the same time, 89% of FX dealers2 believe that uncleared margin requirements have negatively impacted their cost of trading.

While these structural challenges impact each fund differently, waiting for the market structure to change in your favor rather than employing a smarter approach to instrument selection is a losing proposition.

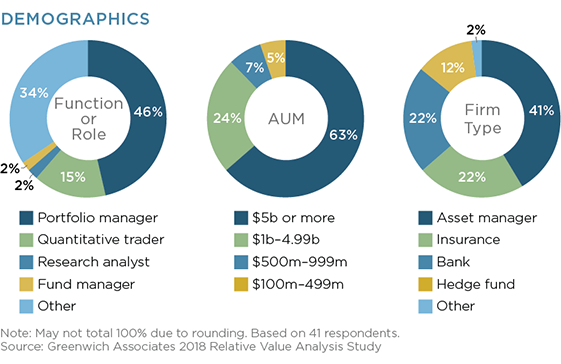

MethodologyFrom November 2017 to February 2018, Greenwich Associates interviewed 41 institutional investors in the United States and Europe to understand current practices relating to product selection and relative value analysis. Our participants included asset managers, insurance companies, banks and hedge funds. Almost two-thirds were firms with assets under management of $5 billion or more.