Digital asset years are like dog years. The changes in 2022 equate to nearly a decade of change in traditional markets. While we saw corrections in the price of assets like Bitcoin (which dropped over 60% during 2022), it was the collapse of Three Arrows Capital (3AC) and the subsequent failure of Alameda Research and the (clearly inevitable, in hindsight) tipping of the FTX domino that ushered in the next phase of digital asset market structure.

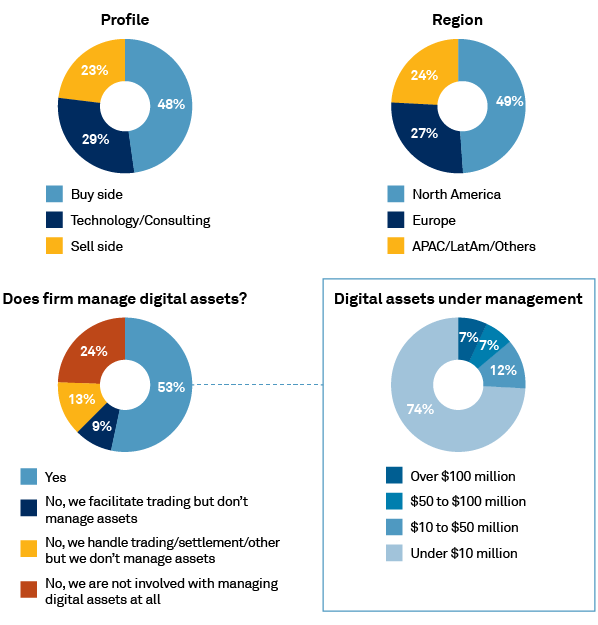

MethodologyIn July and August of 2022, we interviewed 205 executives globally at buy-side, sell-side and technology firms to better understand digital asset market structure. Respondents comprised asset managers, banks, brokers, exchanges, market infrastructures, technology companies, and other market participants. Eighty-six of the respondents manage digital assets.

We spoke with professionals in various roles across the front office, technology/operations/risk, senior management, and strategy teams. Fifty-two percent of respondents are focused or extremely focused on implementing blockchain capital markets at their firms. Also, 68% have an optimistic attitude toward blockchain capital markets.