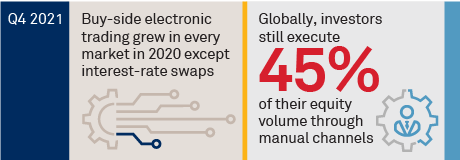

A lot has happened since the beginning of 2020, including the growth of electronic trading in nearly every major asset class around the world. Coalition Greenwich interviews roughly 4,000 investors each year who trade and invest in fixed income, equities and foreign exchange. It is apparent from their trading activity that trading automation continues to pick up steam even in the most electronic markets.

Looking ahead, there are signs of e-trading hitting markets once viewed as impossible to automate, from loans to CLOs to TRS. We look forward to watching those markets evolve, as we have the rest, and tracking their growth for years to come.

MethodologyThroughout 2020, Coalition Greenwich interviewed 663 asset managers, hedge funds, insurance companies and government entities globally to better understand their trading activity and dealer relationships. Electronic trading percentages are based on the aggregate of reported levels of electronic trading for each firm in each individual asset class. Electronic trading is defined differently in each asset class but broadly includes trades that were executed via a multidealer electronic channel, such as an exchange central limit order book or request-for-quote platform. Electronic trading does not include trades executed via chat or email.