ETFs help institutions manage their cash flow, hedge risk, gain quick exposures to illiquid market segments and more. But for institutional use of ETFs to grow and mature, long-held structures for managing clients and trading products need to change.

To an asset manager, they are just portfolios packaged up under a particular regulatory construct and analogous to ‘40 Act mutual funds. Most equity broker-dealers and market makers see them as simply equities: If it looks and feels like a stock, than it should be traded like a stock. Some fixed-income traders treat ETFs like derivatives—a quick way to get broad market exposure to an otherwise illiquid market segment. ETFs are used as credit default swap (CDS) replacements and to help trade baskets of bonds. To many real-money investors—nearly 60% according to recent Greenwich Associates research—ETFs are simply a cheaper alternative to mutual funds. Why pay 100 basis points to track an index when you can pay 10?

The multifaceted nature of ETFs speaks to the huge benefits they have brought to the market and explain, in part, why more than $5 trillion is now managed within ETFs. However, the many faces of ETFs have made them very difficult for banks to manage and have left many investors executing their ETF trades suboptimally. They are not single stocks, so trading them via the same algorithms isn’t wise. And while fixed-income ETFs trade on equity exchanges, they move like the bond market, putting equity traders out of their comfort zone.

To rectify these and similar concerns, the market should begin treating ETFs as a traded instrument all its own. Corporate bond traders didn’t trade CDS when they first came on the scene—CDS specialists did that. ETFs should be treated no differently.

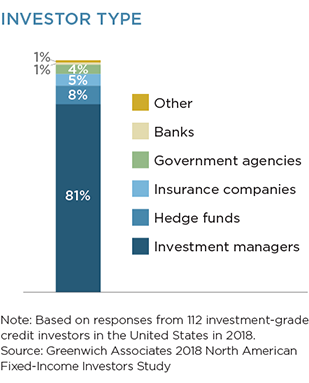

MethodologyBased on 111 interviews with investment-grade credit investors in the United States in 2017 and 112 in 2018. Major broker-dealers, ETF market makers and ETF issuers were also interviewed for this research.