Table of Contents

Greenwich Market Trend reports cover fixed-income, equities and foreign exchange.

Our research examines financial product usage, market share, market sizing, electronic trading, perceive regulatory impact, and much more. We conduct over 12,000 annual interviews.

Greenwich Associates insights are underpinned by in-person interviews with key executives at large and small firms globally and generally fall into three categories:

Market Trends

- Strategic shifts in the market

- Customer behavior and selection criteria

- Multi-year trends and analysis

- Strategic implications: opportunities and threats, competitive landscape and benchmarking

Competitive Landscape and Evolution

- Competitive positioning and gap

- Perceived strengths, weaknesses, threat

- Performance benchmarking and tracking

- Prescriptive recommendations and action

- Case studies and role model

Individual Account Data

- Name-level intelligence to inform sales tactics, segmentation, prioritization, account planning, wallet profiling, resource allocation

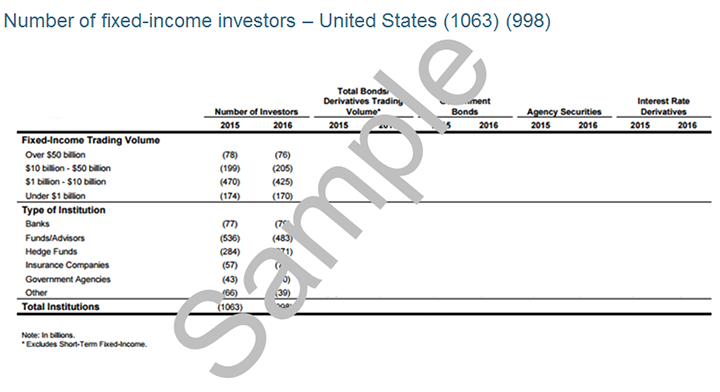

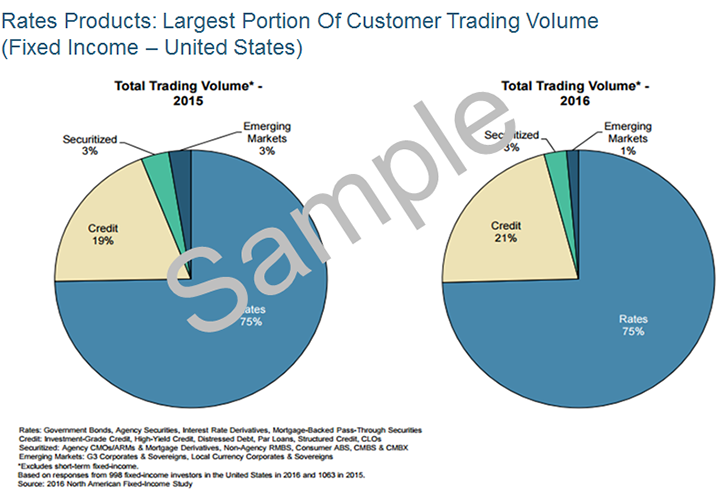

Fixed-Income: Sample of Market-Level Insights

Market Information

- Trading volume by product

- AUM by product

- Relative importance of sales, research, secondary market execution, new issues, clearing, repo/financing, and back office in business allocation

- Current and expected use of nonbank liquidity provider

- Impact of business allocation in a product by the relationship with the dealer in other asset classes

- Influence of trading flow products on the amount of high-value business shown

- Research services clients would be most inclined to pay in cash in light of proposed regulations in Europe

Product Level Detail

- Investment-Grade Credit

- Demand for investment-grade credit derivatives by product

- Use of investment-grade ETF

- Interest Rate Derivative

- Expected proportion of OTC swaps to shift to IR swaps futures or treasury/euro-denominated future

- Change of business due to non-bank liquidity provider

E-Trading

- Multi-dealer platforms currently used

- Forward momentum for platforms currently used

- Preferred platforms for pre-trade discovery

- Show voice trades due to electronic liquidity

- Demand for electronic trading

- Proportion of trading volume traded electronically

- Expected use of new platform

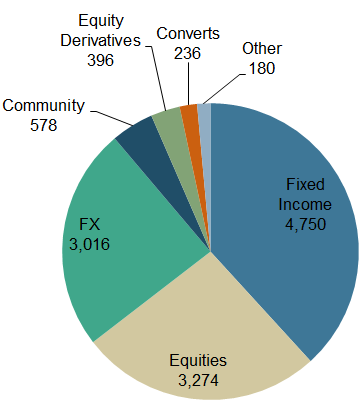

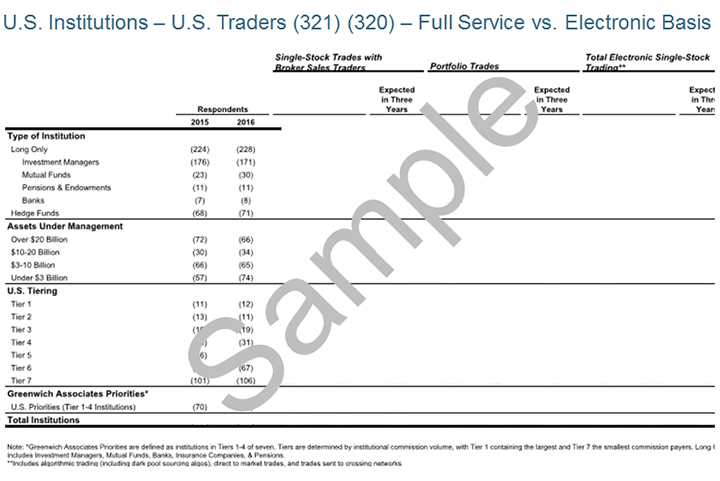

Equities - Sample of Market Level Insights

Market Information

- Total U.S. equity assets under management and commissions

- Expected change in total U.S. equity commissions

- Percentage of commissions from small/mid-cap trades

- Percentage of commissions related to trades for passive/quantitative strategies

- All-in blended commission rates — current and forecasted

- Current and expected trading volume executed via sales traders, electronic single-stock trades using algorithms or sent to crossing networks, or portfolio trades

- Proportion of commissions allocated to research/advisory services, capital commitment, sales trading, and agency execution

- Proportion of high-touch business requiring capital commitment

- Degree to which commission allocation varies from the broker vote

- Use of formal best execution committees to evaluate trading performance

- Current and expected number of trading firms

- Concentration of trading business with leading ten brokers

- Use of emerging brokerage firms and number of emerging brokerage firms used

- Proportion of business done with emerging brokers and mix of trades executed directly with emerging brokers, through other broker’s electronic trading systems or as “step-outs” (i.e., the emerging broker settles the trade, but does not execute)

- Typical execution practice with emerging brokers (e.g., emerging broker executes the entire block; lessen net capital requirements in approving emerging brokers, etc.)

- Number of buy-side traders at institution

- Use of commission management arrangement

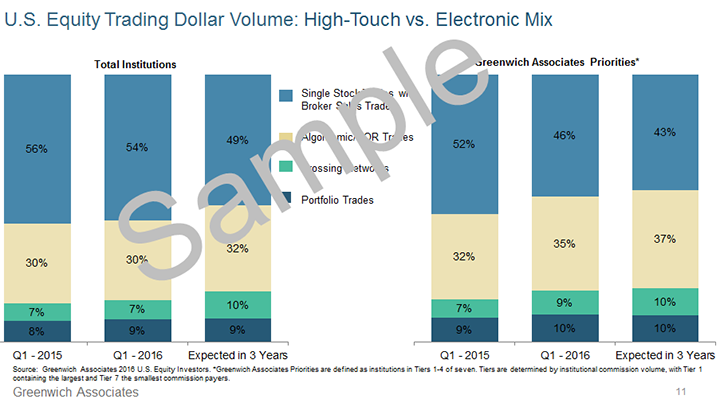

High-Touch vs. Electronic Mix

For the 12 months ended Q1 2016, a stable 37% of U.S. equity trading dollar volume was executed via electronic trades by buy-side Long Onlys and Hedge Funds (excluding any HFT, broker-dealer or retail flows). The mix was again comprised of 30% algorithmic/smart-order routing trading and 7% via crossing networks.

Notably, larger commission Greenwich Priority accounts (about 25% by number, but generated almost 70% of total commission pool) remain more active users of electronic trading and increased such flows from 39% to 44% of volume, split 35% via algorithmic/smart-order routing and 9% via crossing networks.

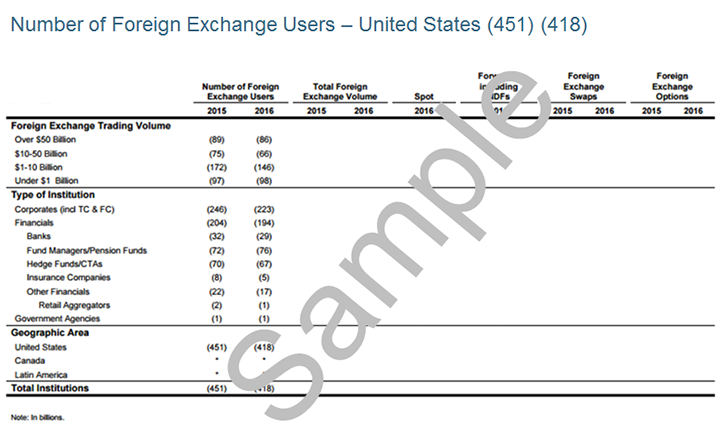

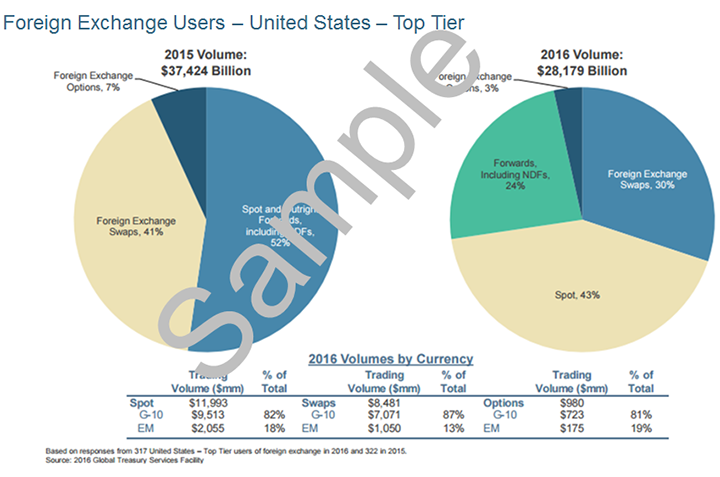

Foreign Exchange - Sample of Market Level Insights

Market Information

- Trading volume in G-10 spot; G 10 forwards (including NDFs); G 10 FX swaps (short dated vs. longer dated of over 1 week); currency option

- Trading volume in EM currencies spot; EM forwards including NDFs; EM swaps; EM option

- Proportion of emerging markets trading volume traded onshore

- Revenue wallet estimation, by account

- Current and planned use of exchange-traded FX futures and option

- Demand for prime brokerage

- Key drivers of FX volume, by account

- Relative importance of sales, relationship management, research, pricing, online offering, breadth of product offerings, back office/ operation

- Use of trading cost analysis

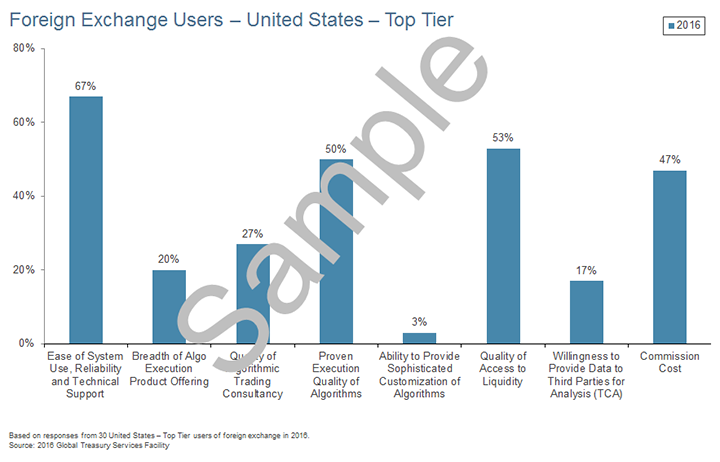

E-Trading

- Expected use of algo tools

- Preferred algo or direct market access (DMA) execution tools

- Type of algo tools used

- Most important criteria when selecting an algo provider

- Proportion of volume done online in FX swaps, G10 spot/outright forwards including non-deliverable forwards, currency options

- Proportion of trading volume done by channel