Table of Contents

As brokers adjust their business strategies to cope with both the post-crisis regulatory framework and a slowdown in institutional trading activity, a top tier of U.S. bulge bracket firms last year established a solid claim as the leaders in U.S. cash equities.

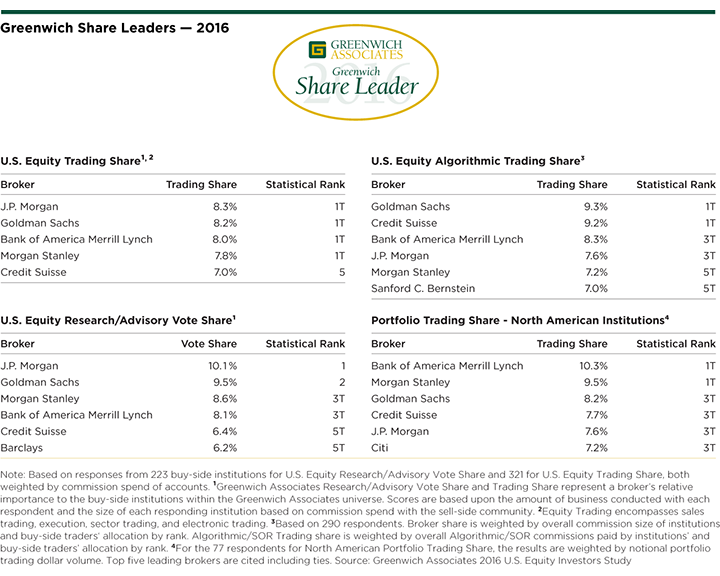

In U.S. Equities Trading, J.P. Morgan is tied at the top of the market with Goldman Sachs, Bank of America Merrill Lynch and Morgan Stanley, all with trading shares between 7.8%–8.3%. Credit Suisse rounds out the top five with a trading share of 7.0%. These firms are the 2016 Greenwich Leaders in U.S. Equity Trading Share.

“Depressed trading volumes have been a drag on revenues and earnings of all the global banks,” says Greenwich Associates consultant Jay Bennett. “In the resulting fierce competition for trading business, a “two-tier top-tier” profile exists, with the first tier doing 32% of the business and the second tier about 28%.”

In U.S. Equity Research/Advisory, J.P. Morgan is in the top spot with a 10.1% share of the commission-weighted institutional investor research/advisory vote, just ahead of an increasing Goldman Sachs at 9.5%. They are followed by Morgan Stanley and Bank of America Merrill Lynch, which are statistically tied at 8.1%–8.6%, and Credit Suisse and Barclays, which are tied at 6.2%–6.4%. These firms are the 2016 Greenwich Leaders in U.S. Equity Research/Advisory Vote Share.

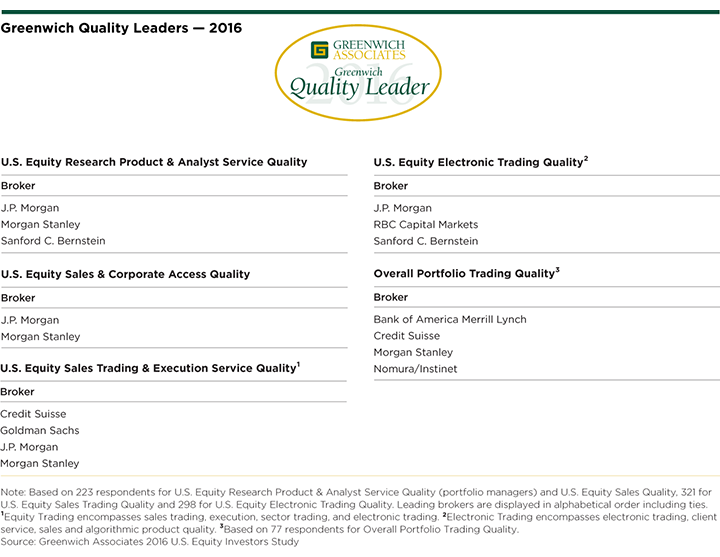

As part of its 2016 U.S. Equity Investors Study, Greenwich Associates interviewed 223 institutional portfolio managers and 321 institutional traders about the brokers they use for U.S. equities. Study participants were asked to name the brokers they use, to estimate the amount of business done with each firm, and to rate the brokers in a series of product and service categories. Firms that received client ratings that top those of competitors by a statistically significant margin were named Greenwich Quality Leaders℠.

J.P. Morgan is the only broker to win a designation as a Greenwich Quality Leader in all three categories considered by Greenwich Associates. The 2016 Greenwich Quality Leaders in U.S. Equity Research Product & Analyst Quality are J.P. Morgan, Morgan Stanley and Sanford C. Bernstein. In addition, J.P. Morgan and Morgan Stanley claim the title of 2016 Greenwich Quality Leaders in U.S. Equity Sales & Corporate Access, while J.P. Morgan joins Credit Suisse, Goldman Sachs and Morgan Stanley as 2016 Greenwich Quality Leaders in U.S. Equity Sales Trading & Execution Services.

Electronic Trading

“Low-touch” electronic trades make up about 55% of U.S. equity trading volume for larger accounts and about 27% of the annual commission pool. Goldman Sachs and Credit Suisse share the No. 1 spot as leading brokers in U.S. Equity Algorithmic Trading with algo commissionweighted trading shares of 9.2–9.3%. Bank of America and J.P. Morgan are next with statistically tied shares of 7.6–8.3%, followed by Morgan Stanley and Sanford C. Bernstein in fifth place, with scores of 7.0–7.2%. These firms are the 2016 Greenwich Leaders℠ in U.S. Equity Algorithmic Trading Share.

The 2016 Greenwich Share Leaders in Portfolio Trading for North American institutions are Bank of America Merrill Lynch, with a 10.3% volume-weighted trading share, followed by Morgan Stanley, with a share of 9.5%, and Goldman Sachs, Credit Suisse, J.P. Morgan and Citi, which are tied with shares of 7.2%–8.2%.

The 2016 Greenwich Quality Leaders in U.S. Electronic Trading are J.P. Morgan, RBC Capital Markets and Sanford C. Bernstein. In Portfolio Trading, this year’s Greenwich Quality Leaders are Bank of America Merrill Lynch, Credit Suisse, Morgan Stanley and Nomura/Instinet.

Small/Mid-Cap Stocks

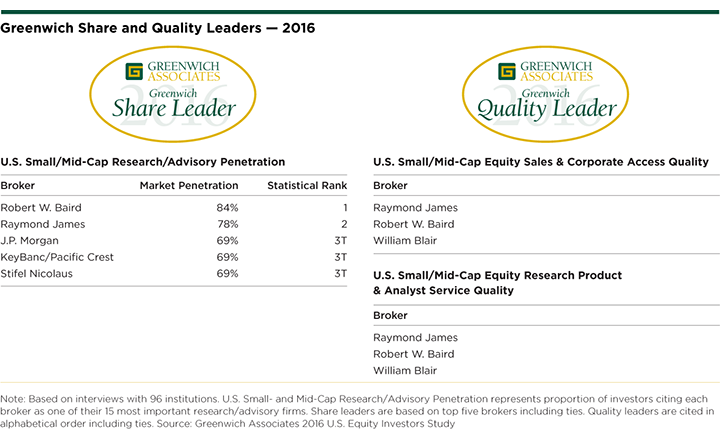

Robert W. Baird maintained its position last year as the most widely used broker for U.S. small/mid-cap equities. Among U.S. institutional investors active in small-cap stocks, 84% use Robert W. Baird as a broker, followed by Raymond James in second place with a market penetration score of 78%. Rounding out the top five are J.P. Morgan, KeyBanc/Pacific Crest and Stifel Nicolaus, which are tied with penetration scores of 69%.

These firms are the 2016 Greenwich Share Leaders in U.S. Small/Mid-Cap Research/Advisory Penetration. The 2016 Greenwich Quality Leaders in both U.S. Small/Mid-Cap Equity Sales & Corporate Access and U.S. Small/Mid-Cap Equity Research Product & Analyst Service are Raymond James, Robert W. Baird and William Blair.

Consultants Jay Bennett, John Colon, John Feng, Richard Johnson, Kevin Kozlowski, and David Stryker advise on institutional equity markets globally.

MethodologyBetween December 2015 and February 2016, Greenwich Associates interviewed 223 U.S. generalist equity portfolio managers, 96 small/mid-cap fund managers and 321 U.S. equity traders at buy-side institutions. The study participants were asked to evaluate the sales, research and trading services they receive from their equity brokers and to report on important market practices and trends.