Despite the recent growth of electronic trading in corporate bonds, a trader is still in control of most trades.

The difficulties inherent in automating the art of bond trading explain why defining best execution remains largely subjective. With clients and regulators scrutinizing every aspect of the investment process, investors must gather and store every piece of data possible to document that best execution was sought beyond a reasonable doubt - an opportunity for technologists to turn art into science.

Methodology

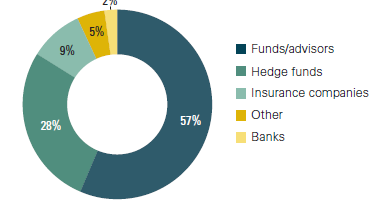

This report provides detailed information on best-execution practices utilized by fixed-income investors located in the U.S. Research is based on in-person and telephone interviews with 114 high-yield credit and 119 investment-grade credit investors throughout 2014.

The data reported in this document reflect solely the views reported to Greenwich Associates by the research participants. Interviewees may be asked about their use of and demand for financial products and services and about investment practices in relevant financial markets. Greenwich Associates compiles the data received, conducts statistical analysis and reviews for presentation purposes in order to produce the final results. Unless otherwise indicated, any opinions or market observations made are strictly our own.

This report provides detailed information on bestexecution practices utilized by fixed-income investors located in the U.S. Research is based on in-person and telephone interviews with 114 high-yield credit and 119 investment-grade credit investors throughout 2014.