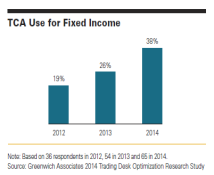

With both regulatory and economic factors feeding the trend, TCA is moving beyond equity and FX markets. Greenwich Associates research shows over one-third of fixed-income investors now use TCA as part of their trading process, up from 19% just two years earlier.

TCA for fixed income remains largely focused on post-trade analysis, with less than 20% of investors using TCA in their pre-trade process. The market is roughly split between vendor-provided and internally built solutions, and is ripe for competition in the coming years and Greenwich Associates anticipates more than half of fixed-income investors using TCA with the next two years.

MethodologyBetween August and September 2014, Greenwich Associates interviewed 358 buy-side traders across the globe working on equity, fixed income or foreign exchange trading desks to learn about trading desk budget allocations, trader staffing levels, OMS/EMS/TCA platform usage, and ATS satisfaction levels.