The U.S. Treasury market has received renewed attention over the past five years, in line with its importance to the global economy. Yet, while the “flash rally” of 2015 and subsequent analysis by U.S. regulators inspired a much needed review of the market structure for U.S. Treasury trading, the focus has been heavily weighted to on-the-run issues, ignoring the liquidity problems that continue to plague the off-the-run market.

While liquidity has become challenged in nearly every fixed-income market since the financial crisis, Greenwich Associates conversations with market participants shows an impactful decline in market depth and a widening in spreads in need of attention. Although renewed incentives for dealers to provide liquidity in off-the-run Treasuries is ideal, innovations in trade-matching technology and approaches are more likely. Examining the differences between market participants, existing trading mechanisms and the needs of investors going forward paints an encouraging picture for the market’s future evolution.

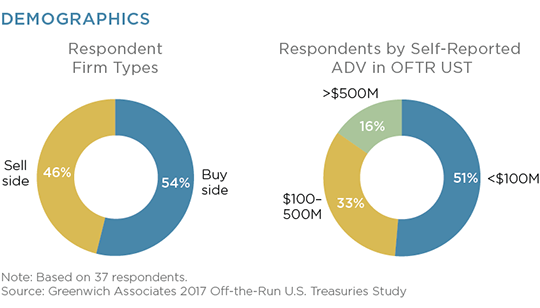

MethodologyIn Q2 2017, Greenwich Associates interviewed 37 U.S.-based individuals across the buy side and sell side, including dealers, asset managers, hedge funds, and central banks to understand the liquidity they see in the U.S. Treasury market. For this research, we focused on exploring the levels of liquidity found in the on-the-run and off-the-run treasury markets since the financial crisis, the use of transaction cost analyses and perceived execution quality.