Table of Contents

A dearth of client trading activity in Japanese government bonds has triggered a push by the country’s largest domestic fixed-income dealers into non-yen products, particularly non-yen government bonds.

Continuous, aggressive and widespread buying ofJapanese government bonds (JGBs) by the country’s central bank as part of the Abe government’s policy of quantitative easing has cut the number of JGBs in circulation and dramatically reduced available liquidity for investors looking to trade in the product.

The results of Greenwich Associates most recent Japanese Fixed-Income Investors Study show a 20%–30% drop inJGB client trading volume from 2014–2015. Major dealers competing in Japan believe the decline in trading volume over that period could have been even more pronounced.

Facing the rapid contraction in their traditional core product market, Japan’s leading fixed-income dealers have been forced to look elsewhere for new revenue opportunities. The list of 2015 Greenwich Leaders in Japanese Fixed Income shows they have found this opportunity in non-yen bonds.

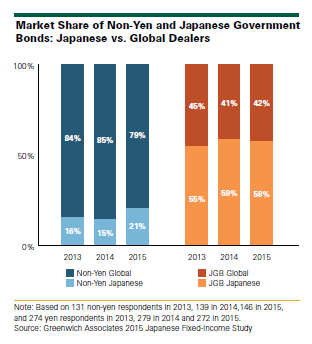

Although foreign firms still dominate the top ranks of Greenwich Share Leaders in non-yen bonds, Japanese dealers are capturing market share in this product at an impressive rate. In 2014, domestic Japanese dealers controlled only 15% of market share in the trading of non-yen government bonds. In 2015, that share soared to 21%.

Greenwich Leaders—International (Non-Yen) Bonds

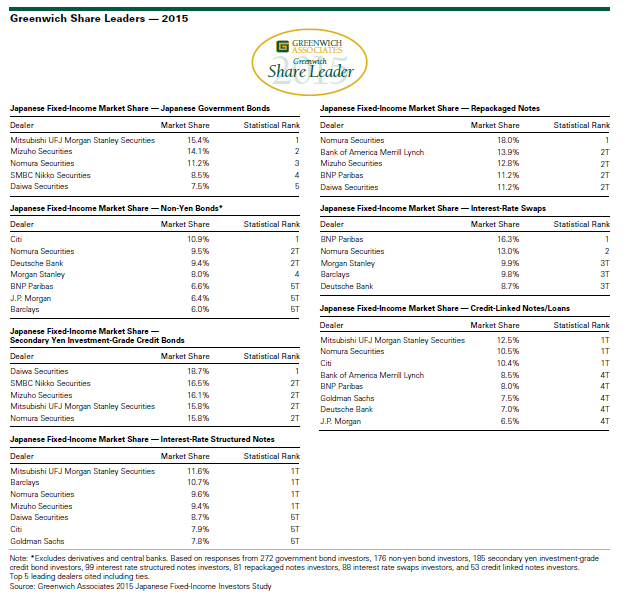

At present, Citi tops the list of Greenwich Share Leaders in Non-Yen Bonds with a market share of 10.9%.

Next is the only Japanese dealer on the list—Nomura Securities—which is statistically tied with Deutsche Bank with market shares of 9.4%–9.5%, followed by Morgan Stanley at 8.0% and BNP Paribas, J.P. Morgan and Barclays, which are statistically tied with market shares of 6.0%–6.6%. “Besides Nomura, all other major Japanese dealers gained share in non-yen bond trading, including Mizuho which has broken into the top 10, as they continue to solicit and win new relationships and trading share,” says Greenwich Associates consultant Tim Sangston.

Some of the gains by Japanese dealers in non-yen bonds can be attributed to a pullback on the part of global dealers.

Faced with new capital reserve requirements in their home markets and continued balance sheet concerns, these large global dealers are cutting costs in markets around the world. They are also narrowing their strategic focus and targeting capital and resources more carefully to their best and potentially most profitable clients, while scaling back coverage for other investors.

“Given the decrease in JGB trading activity and other challenges facing these firms, some large foreign dealers have sharply scaled back the number of clients they want and are willing to service,” says Greenwich Associates consultant John Feng. “Relationships and trading business ceded by these firms have been picked up by the Japanese domestic dealers.”

That is not to say the advance of Japanese firms in nonyen bonds is a product of retrenchment by their competitors. To the contrary, Japanese dealers are picking up significant market share among Japanese mega-banks, trust banks and life insurance companies—all of which are viewed as important target clients by global and domestic dealers alike. “Japanese dealers have broad capabilities and deep and long-term relationships with domestic institutions,” says Greenwich Associates consultant Tomio Sumiyoshi. “As they shift their focus from JGBs, they are leveraging their high-quality platforms and these deep ties to domestic investors to expand their presence in non-yen bonds.”

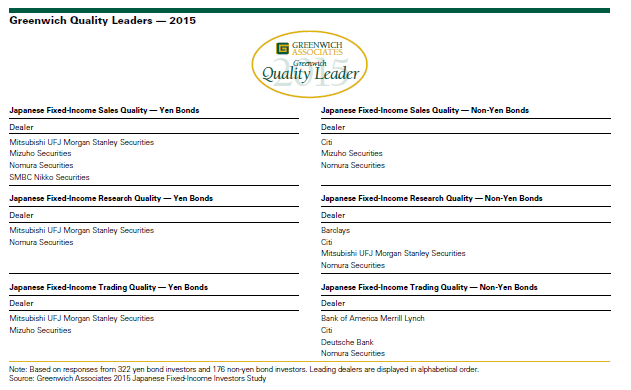

In fact, a number of Japanese dealers appear on the list of 2015 Greenwich Quality Leaders in Non-Yen Bonds. Every year, Greenwich Associates asks institutions participating in its Japanese Fixed-Income Investors Study to name the dealers they use in specific fixed-income products, estimate the volume of business they allocate to each dealer and to rate these dealers in a series of product and service categories. In 2015, the Firm used input from nearly 450 Japanese investors to determine the Greenwich Share and Quality Leaders in Japanese Fixed Income. Greenwich Quality Leaders are dealers that receive client ratings topping those of competitors by a statistically significant margin.

In Non-Yen Bond Trading, Nomura Securities joins Bank of America Merrill Lynch, Citi and Deutsche Bank as 2015 Greenwich Quality Leaders. In Non-Yen Bond Research, the 2015 Greenwich Quality Leaders include two global firms, Barclays and Citi, and two Japanese dealers, Mitsubishi UFJ Morgan Stanley Securities and Nomura Securities. The 2015 Greenwich Quality Leaders in Non-Yen Bond Sales are Citi, Mizuho Securities and Nomura Securities.

Japanese Government Bonds

Of course, the Japanese dealers have maintained their dominant market shares in the shrinking JGB market. Mitsubishi UFJ Morgan Stanley Securities and Mizuho Securities rank first and second with JGB market shares of 14.1%–15.4%, respectively. Rounding out the Top 5 are Nomura Securities at 11.2%, SMBC Nikko Securities at 8.5% and Daiwa Securities at 7.5%.

Japanese firms also account for the entire list of Greenwich Share leaders in Secondary Yen Investment-Grade Credit Bonds—a market that actually experienced a modest gain in trading activity from 2014 to 2015. Daiwa Securities leads the market with an 18.7% market share, followed by SMBC Nikko Securities, Mizuho Securities, Mitsubishi UFJ Morgan Stanley Securities, and Nomura Securities, which are statistically deadlocked with market shares of 15.8%–16.5%.

For the first time, Greenwich Associates in 2015 analyzed the competitive landscape of the market in differing JGB maturities. To do so, we divided the market into categories of maturities of less than 2 years, 2–5 years, 5–7 years, 7–10 years and longer than 10 years. Foreign dealers tend to do better at the longer end of the curve, with Goldman Sachs and Barclays ranking in the Top 5 in trading share in the 10-year+ maturity category.

Domestic Japanese dealers entirely dominate the list of 2015 Greenwich Quality Leaders in Yen Bonds, with Mitsubishi UFJ Morgan Stanley Securities and Mizuho Securities taking the honors in Trading, Mitsubishi UFJ Morgan Stanley Securities and Nomura Securities claiming the title in Research, and the quartet of Mitsubishi UFJ Morgan Stanley Securities, Mizuho Securities, Nomura Securities, and SMBC Nikko Securities winning the title in Sales.

Japanese Interest-Rate Swaps

Dealers both foreign and domestic are also responding to the plunge in JGB trading volume by focusing on the less capital-intensive swaps market. BNP Paribas leads the list of 2015 Greenwich Share Leaders in Japanese Interest-Rate Swaps with a market share of 16.3%, followed by Nomura Securities at 13.0%, and Morgan Stanley, Barclays and Deutsche Bank, which are statistically tied at 8.7%–9.9%. “Global banks have traditionally done well in Japanese interest-rate swaps in part because the business is very concentrated from an investor standpoint,” says Greenwich Associates consultant Taeko Sumiyoshi. “There are a handful of large life insurance companies, mega-banks and trust banks that generate the vast bulk of trading volumes, so you don’t need a big footprint to be successful.”

Structured notes remain popular in Japan, as return starved institutions continue to be attracted to the product’s yield potential. Because the investor base is made up largely of regional Japanese institutions, domestic dealers tend to dominate the business. The one big exception is Barclays, which is statistically deadlocked atop the list of 2015 Greenwich Share Leaders in Japanese Interest-Rate Structured Notes with Mitsubishi UFJ Morgan Stanley Securities, Nomura Securities and Mizuho Securities with market shares of 9.4%–11.6%, followed by Daiwa Securities at 8.7%. Although they do not crack the list of 2015 Share Leaders, global dealers including Citi, Goldman Sachs and Bank of America Merrill Lynch all gained market share in this product from 2014–2015.

The list of 2015 Greenwich Share Leaders in Japanese Credit-Linked Notes and Repackaged Notes includes a mix of domestic Japanese and global dealers. As in structured notes, investor demand for these structured credit products comes largely from regional Japanese institutions looking for yield in the low interest-rate environment.

Consultants John Feng, Tim Sangston, Taeko Sumiyoshi, and Tomio Sumiyoshi advise on the institutional fixed-income market in Japan.

MethodologyBetween May and July 2015, Greenwich Associates conducted 272 interviews with senior investment professionals in Japan investing in domestic fixed income and 176 interviews with senior investment professionals in Japan investing in international fixed income. Interviews were conducted with banks, investment companies and insurance companies.

16-4000

© 2016 Greenwich Associates, LLC. Javelin Research & Strategy is a division of Greenwich Associates. All rights reserved. No portion of these materials may be copied, reproduced, distributed or transmitted, electronically or otherwise, to external parties or publicly without the permission of Greenwich Associates, LLC. Greenwich Associates®, Competitive Challenges®, Greenwich Quality Index®, and Greenwich Reports® are registered marks of Greenwich Associates, LLC. Greenwich Associates may also have rights in certain other marks used in these materials.

The Greenwich Quality LeaderSM and Greenwich Share LeaderSM designations are determined entirely by the results of the interviews described above and do not represent opinions or endorsements by Greenwich Associates or its staff. Such designations are a product of numerical scores in Greenwich Associates’ proprietary studies that are generated from the study interviews and are based on a statistical significance confidence level of at least 80%. No advertising, promotional or other commercial use can be made of any name, mark or logo of Greenwich Associates without the express prior written consent of Greenwich Associates.