The U.S. Treasury “flash crash” on October 15, 2014 acted as a catalyst for market structure change.

A market-wide feeling of content with existing relationships, protocols and platforms saw regulatory and product strategy teams focusing on other markets with more pressing issues, like corporate bonds and swaps.

The past year has seen this attitude change, with new business models and trading mechanisms threatening to blur the lines between liquidity makers and liquidity takers.

Through conversations with primary dealers, principal trading firms and major investors, Greenwich Associates examines how the market structure is changing at the hands of new technology, regulatory changes and market participants willing to interact with one another in ways they never have before.

Methodology

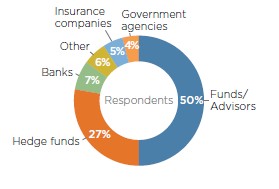

In the spring and summer of 2015, Greenwich Associates interviewed 103 U.S. institutional investors active in U.S. Treasuries, 13 dealers that collectively handle nearly 80% of all client trading in U.S. Treasuries, and six of the highest volume principal trading firms in the U.S. Treasury market.

Buy-side participants included traders and portfolio managers, while sell-side participants included heads of electronic sales, heads of trading and heads of trading technology.

Interview topics included trading strategies, product and dealer use, trading platform evaluations, and various related market structure topics.