Hope and lofty expectations for change were at the heart of corporate bond market innovation conversations a decade ago. Today, many of those hopes and expectations have become reality and, in some cases, have gone much further than anyone could have imagined.

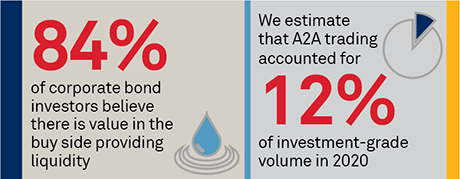

The nearly one-third of volume traded electronically in the United States now consists of much more than dealer-to-client RFQ trading. In all-to-all markets, where asset managers provide liquidity to dealers and each other, dealers trade with one another electronically, and nonbank liquidity providers that are building up notable client franchises are now at the center of the corporate bond market’s growth and evolution.

This is by no means a story of platforms and the buy side disintermediating the dealers. The big dealers themselves have reshaped their businesses to trade profitably via algorithms, managing client relationships electronically, and to interact with anonymous liquidity in markets in ways that few if any people expected.

This progress has created a virtuous cycle. Electronic executions have grown because more and more accurate real-time data is now available to all market participants. And the more electronic executions grow, the more accurate and plentiful real-time data can become. This data allows for both better pre-trade analytics: Which liquidity pool is right for my trade right now? And it then allows for a better analysis of those executions post-trade, which makes pre-trade analytics even smarter the next time.

While this evolution has disrupted long-held views on how the market does and should function, liquidity takers and liquidity providers have adapted as they have for all of the market’s history—to best utilize this new market structure to grow their business and keep their clients happy and coming back for more.

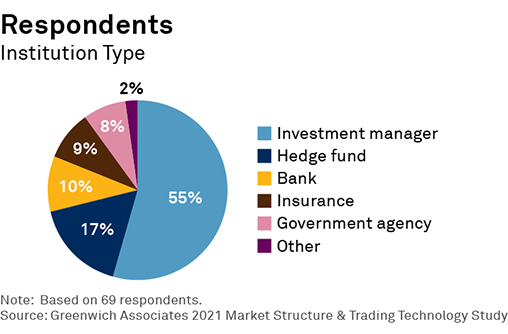

MethodologyIn Q4 2020, Greenwich Associates interviewed 69 U.S.-based corporate bond investors. Respondents were asked a series of qualitative and quantitative questions about various corporate bond market structure issues, such as electronic trading, provision of liquidity and information leakage. In addition, analysis provided by trading venues and market participants, available via Greenwich MarketView, helps inform on trading activity segmented by trading protocols such as RFQ, CLOB and voice trades.