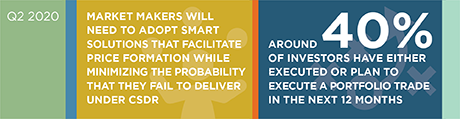

CSDR will lead to marked changes in market structure and impinge on all aspects of traders' responsibilities. As the demands on European buy-side traders' time continue to ratchet up, they have no option but to embrace technology to avoid becoming overwhelmed. These potential regulatory changes give fixed-income desk heads an opportunity to strategically review their operations and invest in the future. Balancing the competing demands of managing a busy desk while making significant operational enhancements will be challenging.

As we have seen in the data, there are opportunities in many areas, such as the new issue process and portfolio trading, to make big productivity gains through more tactical changes. The level of technology adoption varies by desk - those that are less automated risk being left behind.

MethodologyIn Q3 2019, Greenwich Associates interviewed 61 European fixed-income investors. Respondents were asked a series of questions regarding their trading behavior in the fixed-income markets, including portfolio trading and auto-execution, as well as their opinion on relevant European market structure issues, such as CSDR.