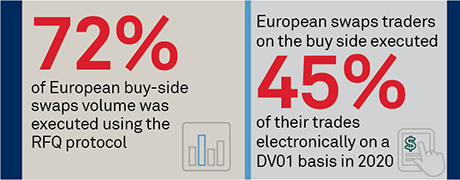

European swaps markets have long led the world in electronic trading. Whereas U.S. markets needed a global credit crisis to create regulations that would drive trading onto the screen, the diversity of European markets looked to electronic solution long before it was required. That trend continues today with electronic trading volume growing faster than the market itself, sometimes because of, and other times, despite major regulatory changes including MiFID II, MiFIR and, most recently, Brexit.

This strong foundation for electronic trading has now created an appetite for new, efficient solutions that will help not only with trading and analyzing the most liquid benchmark instruments, but also with finding liquidity in bespoke, emerging market and generally less-liquid instruments that, until recently, have stayed offline. The growth of list trading, request-for-market protocols and transaction cost analysis (TCA) usage is shepherding in what looks to be a new era for the swaps market in Europe.

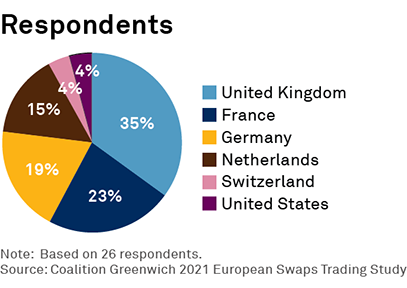

MethodologyBetween December 2020 and February 2021, we interviewed 26 buy-side European swaps traders based primarily in the European Union and the United Kingdom. Conversations focused on the use of electronic trading today, expectations for change in the future, and areas where swaps traders would like to see growth or improvement.