The interest-rate derivatives (IRD) market has acted and continues to act as an important toolset for market participants around the world. At the start of 2022, the industry is focused on a number of key changes affecting how the market will operate in the future. Two of these stand out.

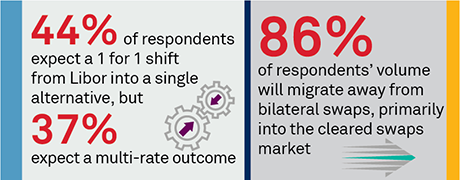

First is the move away from Libor through the shifting of volumes to alternative rates and the derivatives that track them. The market will certainly utilize rates recommended by bodies such as the Federal Reserve’s Alternative Reference Rates Committee (ARRC), with SOFR being one example. But it is also looking to alternative rates that include credit sensitivity, such as Bloomberg’s BSBY.

Second, as the buy side continues to shift volumes to clearing, central counterparty clearing houses (CCPs) will need to invest in areas such as the range of products offered, cross-currency product capabilities and margin optimization to entice flow from the buy side. While there is more to the market’s evolution than the Libor transition and increased clearing of over-the-counter (OTC) IRDs, these two initiatives will remain front and center and shape the market going forward.

MethodologyBetween June and August 2021, Coalition Greenwich conducted interviews with 28 senior interest-rate derivatives professionals to better understand the market participants and the likely path ahead for OTC IRD. Study participants represent a range of organization types, including buy side, sell side and liquidity providers. Questions explored how client needs, market structure evolution, regulatory changes, and cost pressures are all driving the markets forward.