More than half a trillion dollars of green bonds were issued in 2021, the highest level since the market was defined. This category encompasses both bonds that include incentives based on issuer behavior (i.e. cutting their carbon footprint) and those for which the proceeds are used for environmental and/or social projects.

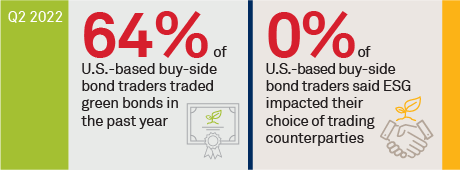

While the investment returns and ultimate impact of these bonds remains a huge source of debate, and 2022 market conditions through May have proven challenging for bond issuance broadly, the long term demand for green bonds is undeniable. This investor demand has then brought forth the need to trade these bonds in the secondary market, with portfolio managers looking for new paper as interest rates and the total number of issuers rise. Based on our interviews with 50 U.S. based buy side bond traders in the fourth quarter of 2021, 64% said they had in fact traded Green Bonds in the past year with another 8% expecting to in the year ahead.

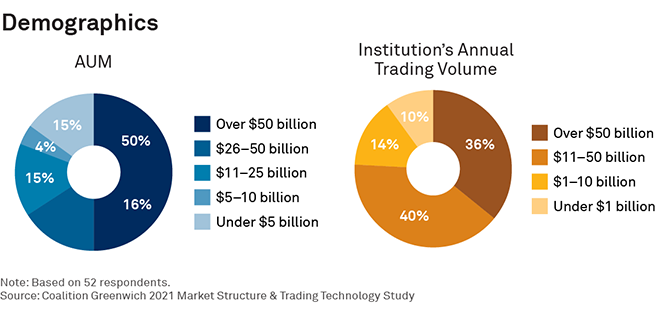

MethodologyThis study is based on responses gathered from 52 U.S.-based buy-side fixed-income traders at asset managers and hedge funds. Questions focused on market structure trends, electronic trading habits and expectations for the market going forward.