Securities services firms occupy a vital role in the smooth functioning of the capital markets industry. Mutual funds, ETFs and others rely on these providers to ensure that the operational processes so integral to the asset manager are smoothly run and that operational risk is minimized.

While securities services firms do not receive the same attention as trading or portfolio management, they remain an integral part of the industry’s infrastructure. Custodians have been adapting to their clients for decades, for example helping facilitate and manage the launch of global funds, ETFs, digital assets and alternative structures.

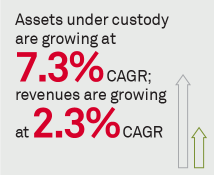

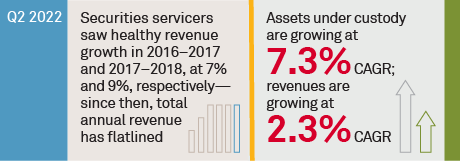

There are new revenue, technology, and asset management trends that are encouraging securities services firms to further innovate and evolve, capturing more revenue from their clients through a significant expansion in services and value proposition.

MethodologyThe Coalition Index for Securities Service tracks the performance of the 12 largest banks, and performance is benchmarked against CRISIL Coalition’s Standard Product Taxonomy.