Credit markets are in a period of transformation, with inflation at a multi-decade high, interest rates rising and the post-pandemic economy still an unknown. Portfolio managers have been diversifying their portfolios over the past year, with even more expecting to branch out into new products and strategies in the year ahead. While this diversification presents new investment opportunities, it also creates several challenges that the market as a whole must overcome.

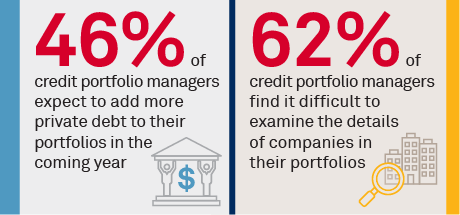

The two thirds of investors in our study that plan to further diversify their portfolios point to the need for less correlated assets, floating rate debt and instruments higher up the capital structure. This has led to increased investments in CLOs and niche private debt. While the supply and demand are present, transparency into these instruments remains limited, especially compared to public securities markets. As such, the demand for more data has come in lockstep with demand for the investments themselves.

Second, the technology used by credit investors has improved dramatically over the past decade. Innovation has come in the form of risk management, portfolio construction, downstream workflows, and electronic trading. However, most of the major systems utilized today have particular areas of strength, whether specific products or specific functionality, making it hard for portfolio managers to expand into new products and strategies.

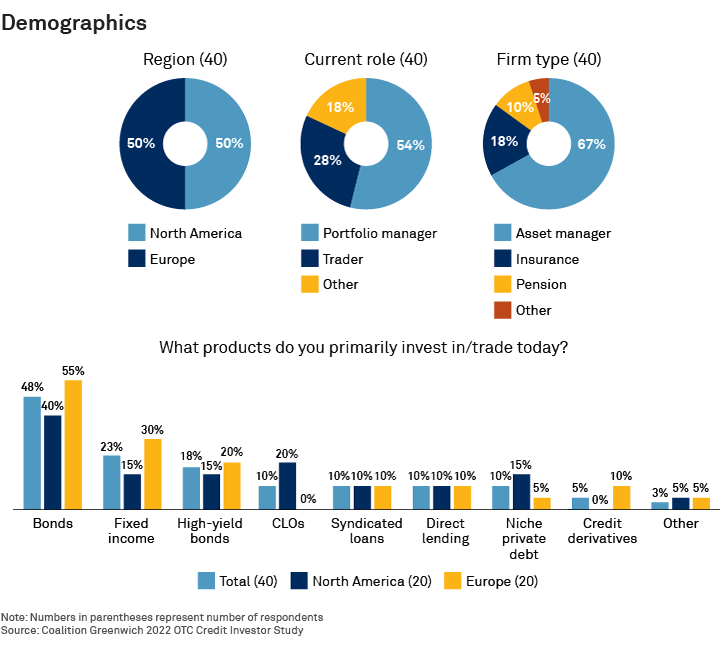

Based on interviews with 40 credit investors in North America and Europe, this research examines the diversification trend in detail and the technology being used to manage the transformation. It also examines the growing importance of private credit markets and the need for increased transparency, as more investors tap those markets for investment returns.

MethodologyIn Q1 2022, Coalition Greenwich interviewed 40 credit investors in North America and Europe. The majority of respondents were portfolio managers and traders at real-money asset managers. Topics covered include expected changes to investment strategy, products traded, technology used, and demands for new investment tools in the future.